CBD Grade A supply hit 25.1 million sqft in Q1

There were 8.7 million sqft of supply in Raffles Place/New Downtown.

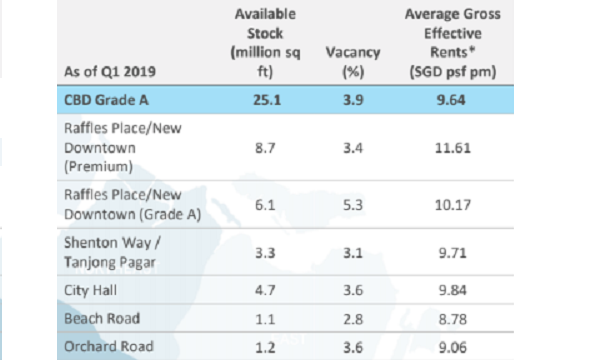

This chart from Colliers International shows that available Grade A office stock in the CBD totalled 25.1 million sqft in Q1, with an average vacancy rate of 3.9% and average gross effective rents of $9.64 psf pm.

Also read: Decentralised offices represented nearly a quarter of office stock in Q4 2018

The Raffles Place/New Downtown submarket had the largest stock of 8.7 million sqft. Average gross effective rents in the area hit $11.61 psf pm.

Also read: New office supply pipeline to hit 7.6 million sqft by 2023

“Driven by a continuous flight to quality and tight vacancy, rental growth in Raffles Place/New Downtown Premium Grade A buildings could remain high. We believe it would be the fastest growing micro-market in 2021-2023 when the area becomes more developed with adequate amenities,” Colliers said.

Similarly, rental costs in the City Hall and Beach Road/Bugis micro-markets could grow faster than historical average (2.1% and 3.7% CAGR, respectively, for 2013-2018) beyond 2022 amidst the upcoming rejuvenation in the precinct; Guoco Midtown and the redevelopment of Shaw Tower are due to be completed in 2022 and 2023, respectively.

Advertise

Advertise