Could the Singapore CBD be revitalised like Sydney's?

Robust net absorption and growing rents paint a positive outlook for the sector.

With the government planning to boost mixed use properties in the CBD, the cosmopolitan centre is set for a rapid transformation over the next few years, in a development that draws parallels with the earlier transformation of Sydney’s CBD, according to a report from JLL.

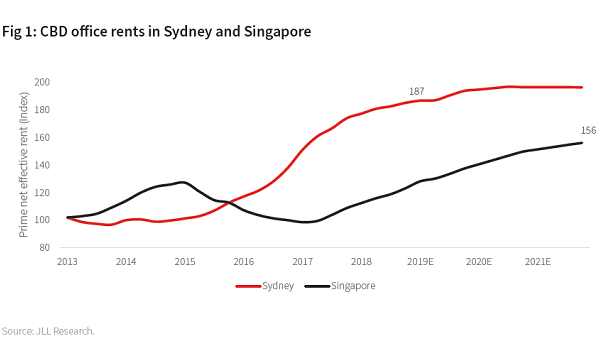

Singapore’s office rents are projected to rise 25% in the next five years following a robust growth rate of 28% over the last nine quarters. The report also noted that the nation’s decentralisation efforts could likely lead to the withdrawals of office stock over the next four to five years. The government’s continuing investment in infrastructure has also led to the facilitated expansion of more hubs in the country.

Also read: URA Draft Master Plan to boost mixed-use properties in CBD

Meanwhile, Sydney’s CBD underwent a transformation over the last few years as its economy and employment rebounded, infrastructure spending surged and office stock was withdrawn in order to give more space for rail projects and residential developments. For the last four years in 2015-2018, office rents in Sydney CBD have skyrocketed 86%.

Australia’s office sector was supported by employment surge in the finance, professional services (including technology), health care and education sectors.

Unlike Singapore, new office supply in Sydney is initiated by the private sector and debt providers require a level of pre-commitment before construction for new projects can commence. On the other hand, JLL hails the Singapore planning system as ‘highly efficient and closely managed’ with the government playing a big role in releasing land for sale every six months or development and new development proposals usually getting approval in less than three months.

Pre-commitment is also not required for construction to begin which means that office supply can be increased more easily than in Sydney, albeit with a 4-5 year development lag.

JLL also suggests that the Singapore office market is in the middle of a rental upcycle, suggesting more room for growth.

“We see some similarities in Singapore, where we think we are only half way through the rental upcycle,” said JLL head of capital markets research Regina Lim.

Rents are set for further upside as Singapore sets its sights in broadening its manpower by 25,000-40,000 a year, with jobs focussing on healthcare, infocomm technology, wholesale trade, financial and professional services sectors.

The city’s employment count in 2018 rose by 38,000 from the average 16,000 per year in the 2015-16 period. The strongest employment growth was seen in the IT and financial services sectors, which grew 4-6% YoY.

“We think this translates to employment growth of 3.5-4.5% pa for these sectors in the next few years, even as Singapore’s overall economy grows at 2-3% annually,” Lim continued.

She also stated that Singapore’s healthy office net absorption will also boost the nation’s office space.

“Over the last six quarters, Singapore occupied office space has increased by 2.5% YoY. This is reflective of the strong employment growth in the professional services sectors, and exceeds expectations based on GDP growth,” Lim continued.

The country is even outperforming its Asian peers in attracting regional headquarters, ahead of Hong Kong and China. Lim cited data from Forbes Magazine, where 46% of large multi-national corporations have set up their Asia headquarters in Singapore, with Hong Kong coming in second at 37%. The trend is more pronounced when considering technology companies. About 59% of global technology firms have established their Asia headquarters in Singapore as well.

Advertise

Advertise