Industrial property sales jumped 27.6% to $1.3b in Q1

Major transactions include factories in Tuas South Avenue and Banyan Drive being sold for $585m and $227.5m, respectively.

Industrial property sales activity picked up by 27.6% YoY, with 286 factory and warehouse properties sold for over $1.3b in Q1 2019, according to Savills.

Some major resales of land parcels that boosted the investment value include single-user factories in Tuas South Avenue 14 and Banyan Drive, which were sold for $585m and $227.5m, respectively.

“This could imply that the industrial sales market was dominated by owner-occupiers instead of investors,” the Savills report stated.

Meanwhile, the upbeat sales momentum for multiple-user factory and warehouse space in Q4 2018 did not extend to 2019, dropping to almost the same sales volume as a year ago.

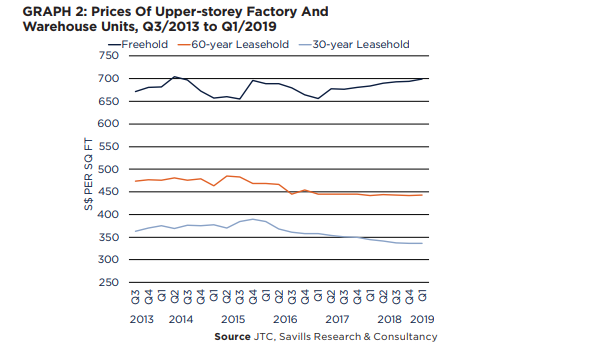

For 30-year leasehold industrial properties, prices slowed from an annual average of 3.6% YoY in 2018 to 2.2% YoY in Q1 2019 although the prices of 60-year leasehold industrial units inched up 0.2% YoY to $443 psf, a first glimmer of recovery after decreasing for over a year. Prices of freehold industrial properties went against market headwinds and after a six-quarter increase approached the record high set in 2014, hitting $699 psf in Q1 2019.

In terms of the leasing market, volumes rose as a total of 2,417 deals were sealed for factory and warehouse space, 3.1% higher YoY and 6.7% more than the three-year quarterly average leasing volume.

“The increase was led mainly by higher leasing demand for single-user factory space due to the segment’s declining rents. The buoyant leasing market was also attributed to the prolonged weakness of the economy as well as the manufacturing sector, which drove industrialists to capitalise on low rents rather than spending capital on purchasing space,” Savills explained in its report.

Leasing demand for single-user factory space combined with the removal of warehouse space resulted in an improved occupancy rate for both segments whilst multiple-user factory space saw a marginal dip due to poor take-up in the Central Planning Region.

With an abundant supply of factory and warehouse space in the market, rental indices extended the YoY decline in Q1 2019, albeit at a slower pace than the period of early-2018. In Q1 2019, the average monthly rent for factory and warehouse space held on at $1.13 psf.

“As business sentiments and conditions are generally not too sanguine, we believe that rents for general factory and warehouse space have fallen to such a level that any further decline would not generate much cost savings to help turn things around for tenants. For tenants already in Singapore, the immediate challenges will be manpower-related and/or whether their goods and services remain in demand,” Savills noted.

Advertise

Advertise