Chart of the Day: Find out why it's unlikely for business park rents to drop big-time

Despite the burgeoning supply.

According to Nomura, the observations suggest the higher supply is largely driven by robust demand for business park space in the One North area.

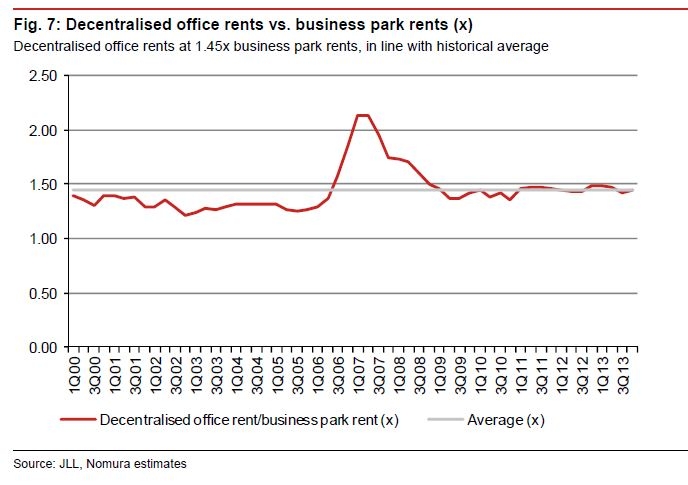

"In addition, we note the increase in business park rents has mostly kept pace with the rise in decentralised office rents (decentralised office rents 1.45x business park rents as of end-4Q13, in line with the average multiple since 2000)," Nomura said.

Here's more:

We believe new high-spec office buildings in decentralised areas completing in 2014F, such as JEM and Westgate in Jurong East, could command premium rents (Westgate, for instance, was sold for c.SGD1,900psf in January and an initial yield of 3.5-4% would imply an average rent of SGD7-8psfpm, vs. the current average decentralised office rent of c.SGD5.50psfpm), which could in turn provide additional buttress to business park rents.

As a result, we think it is unlikely for business park rents to fall significantly in 2016F, notwithstanding the projected supply, and we expect overall business park occupancy to remain above 85% by end-2016F.

Advertise

Advertise