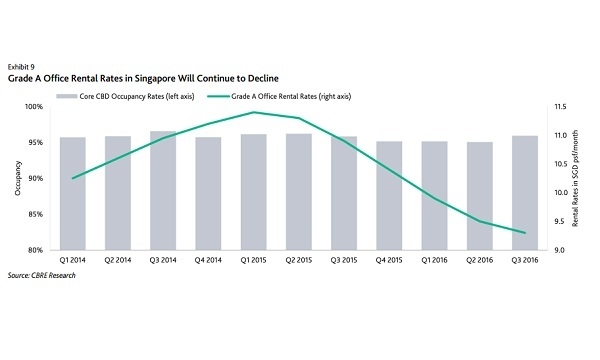

Chart of the Day: Grade A office rents poised to slump as supply surges

Rents in CBD went down to below $9.5 psf/month in Q3.

A glut of office space in the Singapore central business district (CBD) in 2017, coupled with tepid leasing demand, will continue to

pressure rental rates, a report by Moody's Investors Service revealed.

Based on the graph, Grade A office rents has been on the downturn since 1Q15, with a slump below $9.5psf/month reflected in 3Q16.

"This reflects the willingness of office landlords to sacrifice rental rates for occupancy during challenging times, which we anticipate will continue next year," the report said.

It added, "We expect supply-side pressure will mount in 2017 as new office developments complete and come on-stream. While market reports indicate that around one-third of the new supply next year has pre-committed leases, this comprises existing CBD tenants relocating from their current premises upon lease expiry to take advantage of depressed rents. As such, we believe net increase in demand remains muted and do not expect the excess office supply to be fully absorbed before 2020."

Advertise

Advertise