Chart of the Day: This graph could be proof that the worst is over for the industrial property sector

Capital values were stable.

Barclays reported that industrial space in 1Q14 largely remained stable, with a pick-up seen in sentiment of manufacturers, supported by an improvement in global macroeconomic conditions.

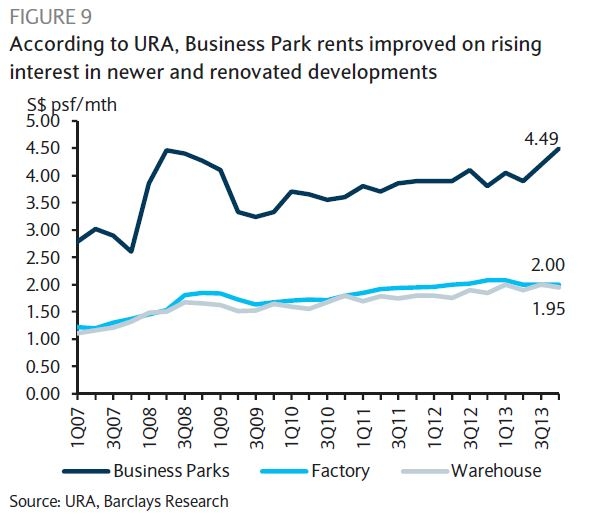

According to Colliers, rentals for Business park space held firm at S$4.05psf/mth stemmed by newer and refurbished developments. The independent high-specs segment registered a marginal decline of 0.3% q/q to S$3.2 psf/mth for the ground floor.

Here's more from Barclays:

Both the conventional factory and warehouse segments also recorded a moderate rental decline of 0.8% q/q to S$2.48psf/mth and S$2.58psf/mth, respectively.

Capital values held stable, with sellers with longer leasehold tenure or higher occupancies holding their expected prices.

Buyers, on the other hand, are expecting lower prices, with some deferring acquisition plans in anticipation of future price correction, according to Colliers. Challenges are significant new supply in 2014 and flight to quality.

Newer and refurbished developments will continue to command higher rentals.

Advertise

Advertise