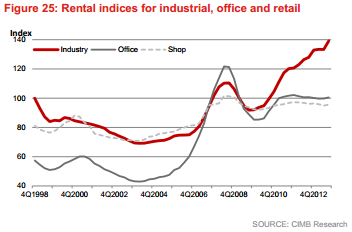

Chart of the Day: Here's proof that Singapore office rents have bottomed out

Due to a growing service sector.

According to CIMB, among the subsectors, it believes that Office rents have bottomed and expect rental growth in 2014 (6-8%) to accelerate in 2015, the result of diminished Grade-A office supply and a growing service sector in Singapore.

Here's more:

Retail rents remain supported by full employment and good pre-commitments (80-100%) ahead of physical completions.

Industrial REITs could face a short-term oversupply, particularly of business-park space, as a large amount of business-park space (1.3m sf in 2013, 1.2m sf in 2014) comes onstream.

In the Hotel segment, growth in new rooms (average of 3,000 rooms per year between 2013 and 2015) could be 5.8% in 2014, still slightly ahead of expected demand growth of 5%. RevPAR weakness is well-known and further weaknessis expected in 2014, albeit lesser.

As the new supply of rooms gets digested, a stronger turnaround in global economies and corporate travel may stabilise RevPAR in 2014.

Advertise

Advertise