Chart of the Day: High amount of office and retail completions to drive transactions in 2015

This is a bright spot in the market.

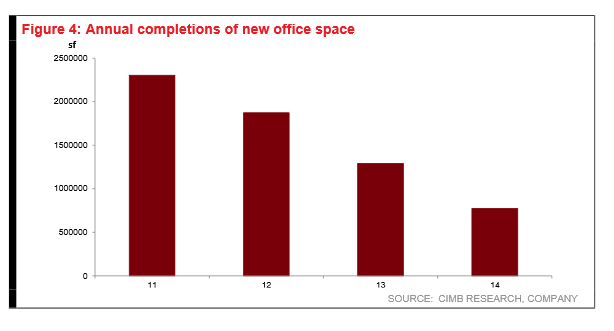

Developers are enjoying more returns from their development activities as the large wave of development and completions of new office and retail inventory over the past 2-3 years mean that assets are generally starting to be well-filled and rents stabilizing.

According to CIMB, these, in turn, could be on-sold to third parties, divested to private funds or to listed platforms such as REITs.

In 2014, there were numerous office transactions to third parties including, sale of Straits Trading Building to Sun Venture Group for S$450m (or cS$2,812psf) and divestment of Equity Plaza for S$550m (or $2,181psf) to a GSH-led consortium as well as sale of 92.8% of Prudential Tower for S$512m (S$2,316psf) to a consortium of 4 parties. In addition, Westgate was also on-sold by Capitaland to Sun Venture and another party jointly for a total of S$579m (S$1900psf) as well as the recent AXA Tower deal to a PREH-led consortium for S$1.17bn (S$1735psf).

CIMB adds that other sizeable and premium quality buildings that could be of interest include CAPL’s Capitagreen, which has seen good take-up at c. 70% leased and could be monetised once its hurdle rate is met.

One Raffles Place could also be monetised to OUE CT once it is stabilised.

Advertise

Advertise