Chart of the Day: There’s still a reason to be bullish on SREITs

They outperform global peers.

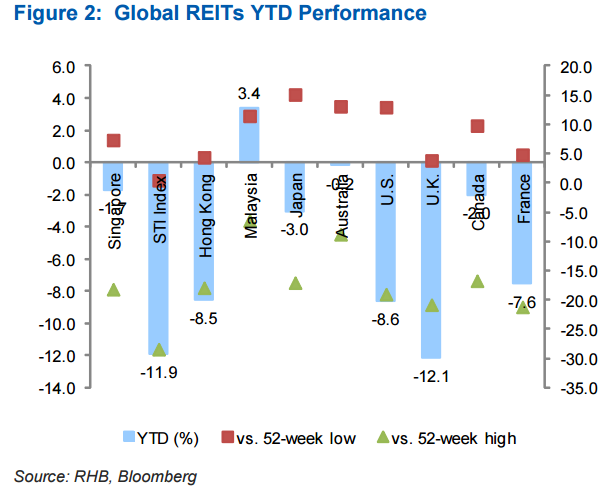

Singapore-listed REITs still outperform their global peers despite heightened stock volatility in the first month of the year.

This chart from RHB shows that SREITs have only declined 1.7% year-to-date, a much smaller decline compared to the 11.9% YTD decline of the benchmark Straits Times Index (STI).

This contraction is also smaller compared to the 8.5% decline recorded by Hong Kong REITs, as well as the 3.0% drop booked by Japan REITs.

REITs listed outside Asia have had an even tougher time. US-listed REITs have declined 8.6% year-to-date, while UK-listed REITs have dropped 12.1% year-to-date. REITs in Canada and France have declined 2.0% and 7.6%, respectively.

The only country to book positive gains is Malaysia, where REITs have gained 3.4% year-to-date. Australian REITs have stayed fairly flat with a mere -0.2% loss year-to-date.

RHB is bullish on locally-listed retail REITs, believing that these counters are highly valuable, in view of the pessimism in the global economic scene. The brokerage house is also positive on REITs which manage business parks.

Advertise

Advertise