Chart of the day: Will leasing activity for prime CBD spaces slump in H2?

Overall Grade A CBD rents dipped 1.1% last quarter.

The marginal increase in office leasing activity in Q2 is just the beginning of a tidal wave of leasing deals in the upcoming Grade A office space projects slated for completion in the next six months, according to a report by Cushman and Wakefield.

Further, it notes that Marina One bagged 550,000 sf in leasing pre-commitments, translating into a pre-commitment rate of 30%. Guoco Tower also saw substantial take-up of space in Q2, as tech firm SAS inked a lease for 20,000 sf of floor space in Guoco Tower and will be jumping from Twenty Anson.

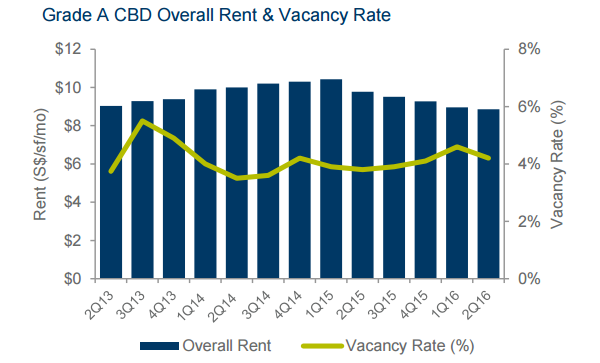

In total, Q2 saw overall Grade A central business district (CBD) vacancy dip 0.4 percentage point to 4.2%.

Cushman & Wakefield asserts that Marina Bay’s vacancy rate slipped to 5.5% from 6%. Similarly, Raffles Place vacancy rate dipped to 2.9%, from the preceding quarter’s 3.7%.

Meanwhile, the overall Grade A CBD rent eased by 1.1% to $8.86 per sqft per month (psf/mo) in Q2.

Rents in Marina Bay dipped 1.4% during the quarter to $9.56 psf/mo, while Raffles Place rents slid 2% to $9.13 psf/mo.

Advertise

Advertise