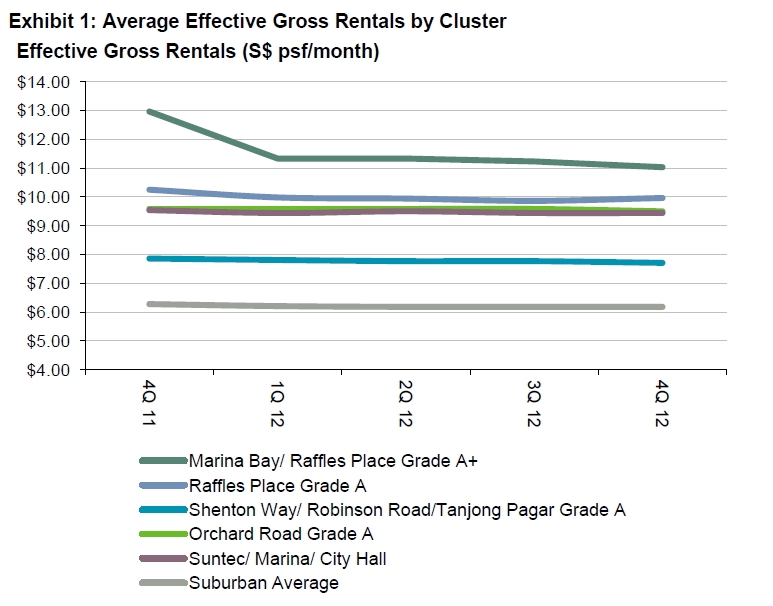

Office space rentals plateau elsewhere except in CBD

Raffles Place/ Marina Bay area posts the biggest quarterly drop in 4Q12.

According to Knight Frank, quarter-on-quarter rental changes across the various office submarkets were marginal with increases in some areas and decreases in others. Generally, the fourth quarter usually sees a slowdown in activity as the festive season nears and key decision makers take a break. In addition, there were no known major MNCs looking into expanding/entering Singapore over the same period, it said.

Here's more from Kinght Frank

Grade A+ buildings in the Raffles Place/ Marina Bay area saw a 1.8 per cent downward revision of rents. Knight Frank notes that this was the biggest quarterly decrease in 4Q 2012 across all submarkets in the office sector. Grade A buildings in Raffles Place conversely saw a marginal q-o-q increase of 1 per cent. Demand for buildings with larger floor plates has been lower as companies who require such spaces have already found their new addresses, while others are affected by uncertainties in the global economy and have postponed such relocation / expansion plans. As such, landlords are willing to negotiate lease terms with larger existing tenants to retain them.

Incentives offered include refurbishment plans. At the same time, a sixmonth rent free period could be offered to prospective tenants.

The narrowing rental gap between Grade A+ buildings and Grade A buildings in the Raffles Place / Marina Bay would present itself as an

attractive alternative for tenants looking for Grade A+ office space.

However, tenants should also factor in the risk of possible rental hikes at their subsequent renewal when demand for Grade A+ space increases.

Over at the Shenton Way / Tanjong Pagar and Robinson Road precinct, office rents dropped by an average of 1.5 per cent in 4Q 2012. Large

occupiers are relocating to the Raffles Place/ Marina Bay area. As a result, the increase in vacant spaces at the Shenton Way/ Tanjong Pagar area has made an impact on rents.

Outside of the Central Business District, rents in the Suntec and Marina Centre remained flat for a second consecutive quarter. The performance of

this cluster is not strongly influenced by performance of office buildings in the Central Business District. While companies in the cluster are similar to those within the CBD, there is a higher presence of firms in the Information Technology and Shipping industries. The cluster has a clear vantage of the Singapore Strait. In addition, as compared to the CBD where vehicular parking spaces are scarce and costly, there are ample parking spaces in Suntec/ Marina Centre.

Rents in the Middle Road/Beach Road saw a 3 per cent q-o-q increase in 4Q 2012. While office space in Orchard continued its stagnation for the

whole year as rents have remained flat since 4Q 2011, offices in Orchard are traditionally long staying tenants and as such, spaces available for

lease are usually small pockets of remnant space.

Similarly, office rents in the suburban areas saw no change from 2Q 2012. Office space demand in suburban areas has been healthy with several

MNCs securing spaces in One@Changi City, UE Bizhub East and the upcoming The Metropolis located at One North.

Advertise

Advertise