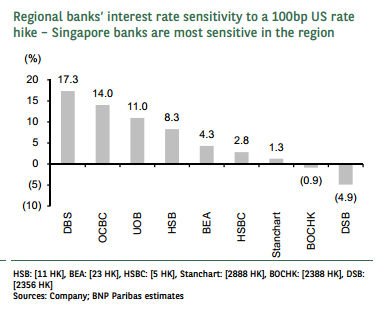

Chart of the Day: Check out which Singapore bank would be most sensitive to a US 100bp rate hike

Its sensitivity increased alongside a rise in HKD and USD loans.

DBS has already outperformed the STI by 15% since 1H14.

According to a report by BNP Paribas, a 100bp rate hike would lift ROE by 18% for DBS, 11% for OCBC and 7% for UOB, in turn lifting 2015E P/Bs by 12- 26%.

DBS has outperformed the STI 15% since 1H14, so analysts from BNP Paribas think OCBC (at 1.2x FY15E P/B) has the most upside potential as the region’s second most rate-sensitive bank.

BNP Paribas adds that for OCBC, its sensitivity to US rate hikes should have increased after its acquisition of WHB given increased total HKD and USD loans.

Advertise

Advertise