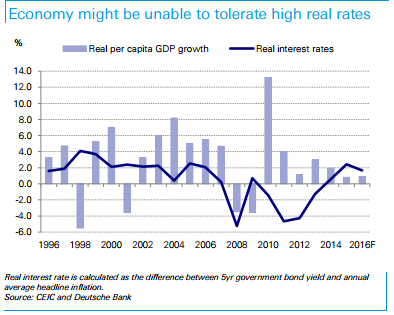

Chart of the Day: Domestic growth might come to a standstill as interest rates rise, analysts warn

High leverage is a key threat.

Singapore is one of the region's most heavily-indebted economies, and experts fear that steep debt burdens might derail economic growth as real interest rates rise.

According to a report by Deutsche Bank, elevated leverage is a cause for concern although debt servicing capacity remains high for both households and corporates.

"A weaker SGD and higher interest rates could increase the debt burden, which in turn could dampen the appetite for capital expansion among firms and spending among consumers," Deutsche Bank said.

“The heavy debt burden also stands to make the economy more vulnerable to adverse income shocks, such as a slowdown in economic activity which could lead to retrenchments or a drop in property prices in which over 45% of household wealth is anchored upon,” the report added.

The chart shows that economic growth will take a hit as borrowing costs normalise, a trend which is exacerbated by persistently negative inflation.

“With the MAS not controlling interest rate policy, but at the same time its liquidity measures to influence the NEER band not helping rates, the question is if Singapore can tolerate higher interest rates at this juncture. With the debt burden so high, we see the answer as a simple no,” Deutsche Bank noted.

Advertise

Advertise