Chart of the Day: See how the economy turned in the last two GST hikes

The hike was implemented staggeredly in weak economic conditions.

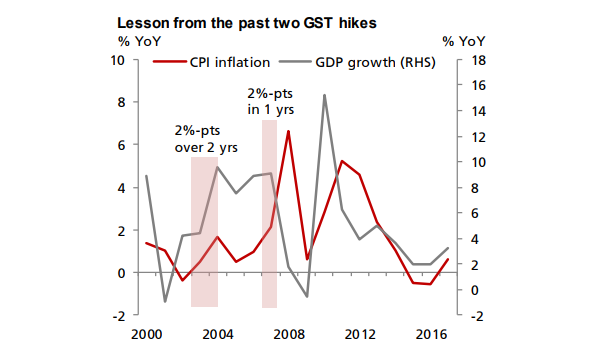

This chart from DBS shows that Singapore has raised its Goods and Services Tax (GST) by 2 ppt in 2003-2004 and 2007 due to underlying economic conditions.

During 2003 to 2004, the economy was emerging from the SARS outbreak. Whilst the economic outlook was improving, GDP growth was still relatively weak, averaging 4.3% between 2002 to 2003.

As a result, the GST was raised in a staggered manner, by 1 ppt each time over a period of two years to ease the impact on households.

In contrast, the following GST hike in July 2007 was straightforward. A one-off 2 ppt hike was introduced against the backdrop of strong economic growth, averaging 9.0% between 2006 to 2007.

Recently, the government has hinted at another GST hike due to deficits in balances.

DBS forecasts the forthcoming GST hike will likely be implemented in a staggered manner, similar to the 2003 to 2004 cycle, with the 2 ppt increase to be introduced over a period of two years.

"We reckon GST rate will be raised by 2 ppt simply because this has been the norm in the past two cycles," DBS said.

Advertise

Advertise