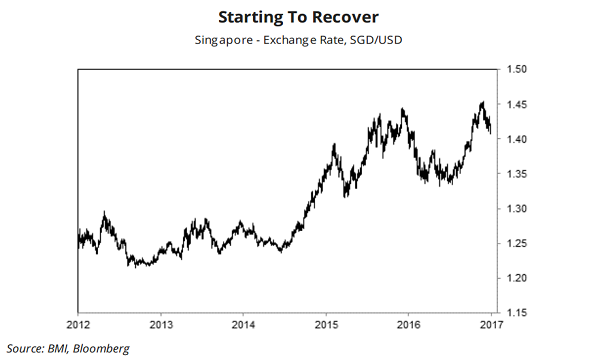

Chart of the Day: Will SGD see a recovery this year?

It has sold off by around 5.4% since its mid-2016 peak.

On the short-term outlook, the Singapore dollar is expected to see a recovery from the real interest rate differential between Singapore and the US, according to BMI Research.

"The Singapore dollar is looking technically positive and is likely to remain on a slight appreciatory trend amid ongoing EM FX stability. We expect the currency to appreciate gradually over the longer term as a strong external position, a relatively sound fiscal outlook, and an undervalued exchange rate lend support to the currency," BMI noted.

The firm noted that the SGD has sold off by approximately 5.4% since its mid-2016 peak and is starting to show signs of recovery.

"Singapore's interest rates are linked to that of the US and will rise with the Fed's rate hiking cycle. However, we expect inflation in Singapore to be considerably lower than that of the US, suggesting that the real interest rate differential between Singapore and the US will remain in favour of the SGD over the coming quarters, supporting the SGD," it added.

Advertise

Advertise