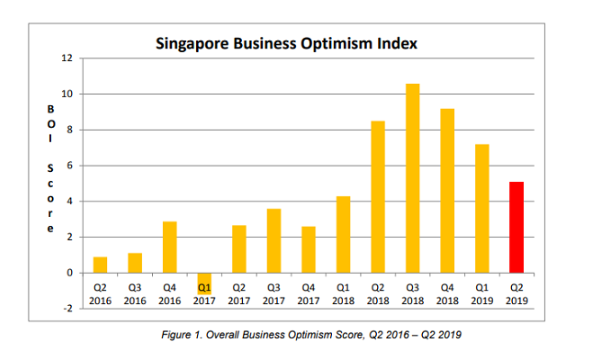

Local business sentiment weakened in Q2 2019

The Business Optimism Index fell to +5.08 points as only four of six indicators are in the expansion zone.

The outlook for local businesses continued to be on the downtrend for the third consecutive quarter in Q2 2019 as the Business Optimism Index (BOI) moderated further from +7.19ppt in Q1 2019 to +5.08ppt, according to Singapore Commercial Credit Bureau (SCCB).

On a year-on-year basis, BOI fell from +8.50ppt in Q2 2018 to +5.08ppt in Q2 2019 and only four of the six indicators are in the expansion zone.

Volume of sales fell to +8.0ppt YoY in Q2 2019 from +13.0ppt whilst net profits moderated further to +5.0ppt in Q2 2019 from +12.5ppt in Q2 2018.

New orders dropped from +15.0ppt to +8.5pptin 2019 and employment levels slid from +10.5ppt in Q2 2018 to +6.5ppt in Q2 2019.

Selling price inched upwards from +3.0ppt in Q2 2018 to +4.0ppt in Q2 2019. Inventory levels remained in the contractionary zone, inching up from -3.0ppt in Q2 2018 to -1.5ppt in Q2 2019.

“The moderation in business sentiments for the next quarter should come as no surprise in light of weaker external demand which has impacted both wholesale trade and manufacturing sectors. This is further exacerbated by the chain effects of a slowdown in China which has led to a moderated outlook within the region,” said Audrey Chia, SCCB’s CEO.

SCCB added that the financial and services sectors have emerged as the most optimistic sectors with all 6 indicators in the positive region for Q2 2019. It is also expected for these sectors to be the key drivers for growth in H1 2019.

This was largely driven by robust demand within the insurance services sub-segment. Both volume of sales and selling price each rose from +4.55ppt in Q1 2019 to +10.53ppt in Q2 2019. Employment levels jumped from 0 percentage point in Q1 2019 to +10.53ppt in Q2 2019.

As for the services sector, SCCB stated that three of six indicators have shown signs of downward moderation.

New orders fell moderately from +24.14ppt in Q1 2019 to +19.72ppt, whilst both inventory levels and employment moderated downwards from +8.62ppt in Q1 2019 to +2.82ppt in Q2 2019 and from +13.79ppt in Q1 2019 to +11.27ppt in Q2 2019 respectively.

The sector’s net profits rebounded from negative territory, rising from -3.45ppt in Q1 2019 to +16.9ppt.

Sentiments within the wholesale sector have taken a turn for the worse with four of six indicators moderating downwards for Q2 2019. This was due to weaker performance in the wholesale trade of machinery and equipment.

Advertise

Advertise