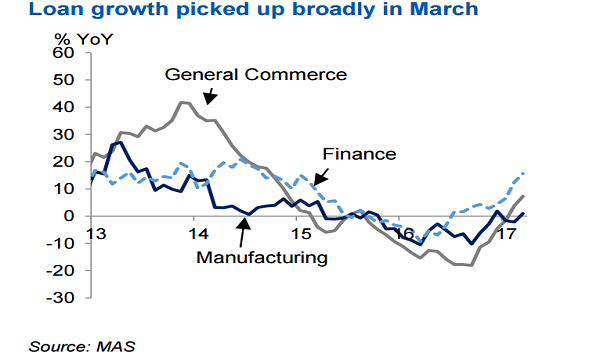

Chart of the Day: Check out the rebound in manufacturing loans

It registered a 1% growth in March.

Bank lending expanded 5.8% YoY in March, accelerating from a 3.5% advance in the month before.

According to UOB KayHian, with this came the rebound in manufacturing cluster, which gained 1% after the 2.1 slump in the month before.

Overall loan demand from businesses accelerated to 7.2% YoY in March from +4.5% in the previous month.

Meanwhile, financial institutions, general commerce, transport storage & communications, business services, professional & private individual loans also picked up.

Here's more from UOB KayHian:

This reflects a broader pick-up in economic activities. Similarly, consumer loans rose 2.2% YoY in March, improving from a 0.8% jump in the month before. Housing & bridging loans increased slightly, while professional & private individual loans contracted at a slower pace.

The latter was supported by a sharp increase in share-financing loans, but was offset partly by more moderate increases in credit card loans.

Advertise

Advertise