Chart of the Day: Check out Singapore banks' customer yields vs. customer cost of funds

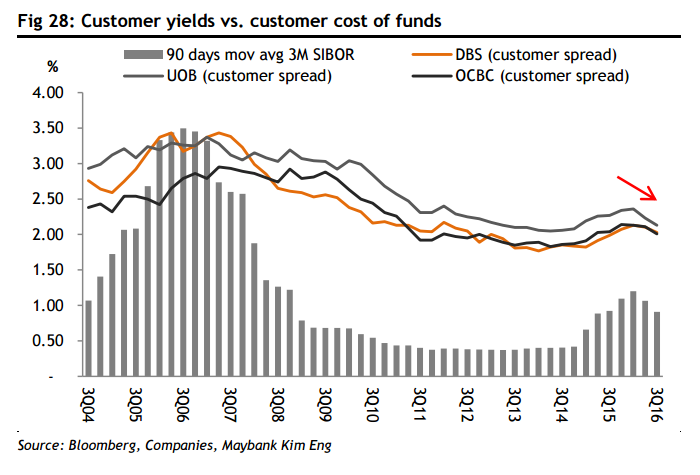

Banks are likely to compromise on loan pricing.

Analysts believe more provisions are likely to be set aside by banks amid the turning credit cycle and lacklustre economic outlook, especially in the oil and gas sector, commodities, and SME sectors.

Maybank KimEng said on average, credit costs of 44bps and 41 bps respectively for FY17-18E across the banks.

"Our estimates for provisions are currently 14-24% and 8-20% above consensus estimates for FY17 and FY18 respectively across the banks. We estimate that if we lower FY17-18E credit costs by 10bps for each bank, FY17-18E net profit will increase by c.6-7%, ceteris paribus. We believe asset quality deterioration has not fully run its course," the research house said.

With this, it noted how operating outlook will remain challenging for 2017 as loan growth will be in the low single digits.

"The lending environment is likely to remain lackluster; and 2) banks may be unwilling to take on higher risks," it said.

As of September 2016, Singapore banks have been lending out faster than the system domestically, where system’s loan growth was -5% YoY vs. the banks’ loan growth at 4-5% YoY.

"Therefore, we think banks are likely to compromise on loan pricing. A normalised interest rate environment can help to offset the fall in customer spreads, although it remains to be seen if customer spreads may be under pressure from competitive loan pricing and lack of repricing for credit spreads," Maybank said.

Advertise

Advertise