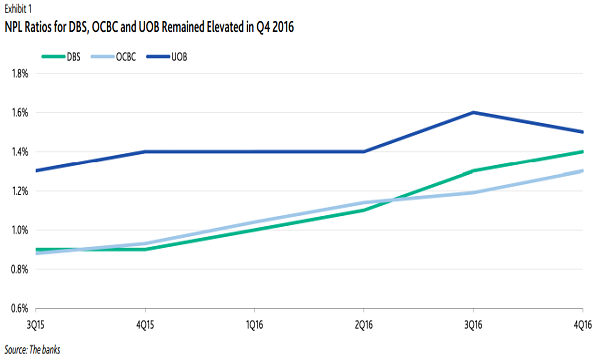

Chart of the Day: Check out which bank recorded the biggest NPL ratio increase in Q4

The said bank narrowed its gap between the other two. The non-performing loan ratio of DBS and OCBC continued to increase moderately in the past quarter, driven mainly by their lending to oil & gas service companies which have been the most severely impacted by low oil prices.

It was UOB which recorded the highest NPL ratio amongst the three, although it is slowly narrowing the gap between its NPL ratio and the rations of the two other banks.

"UOB's asset quality improved in Q4 2016, through fewer new NPLs, recoveries through collateral disposals, and some write-offs," Moody's Investors Service noted.

The research entity noted that the asset quality challenges posed by the troubled oil & gas service companies will persist over the next few quarters.

"Nonetheless, new nonperforming asset (NPA) formations for such companies should normalise, facilitated by gradually stabilising operating conditions in the industry following the trough in 2016. OCBC and DBS have said that their NPLs for this segment will stabilise if oil prices reach USD60/barrel — in terms of Brent crude — and remain at that level for some time. Such a level would be close to the USD50-USD55/barrel seen in recent months," it explained.

Advertise

Advertise