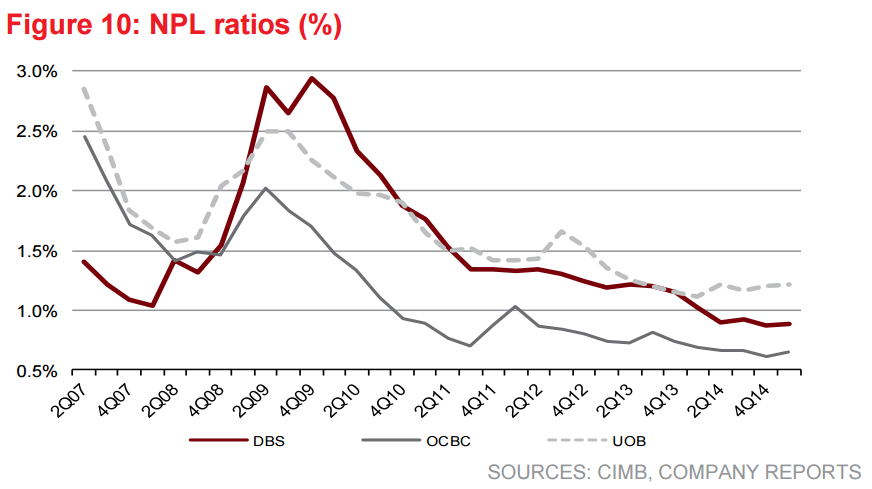

Chart of the Day: Delinquent loans are a sore spot for local banks

Discover who's most at risk.

Non-performing loans (NPLs) are a spot of bother for Singapore's three largest banks, according to this chart from CIMB.

Compared to fears over the Greek crisis, CIMB believes that banks should worry more about delinquent loans at home and within the region.

"We are more concerned about operational NPLs or possible NPLs that stem from the customer lending business, closer to home. There are three possible pots of NPLs that we are concerned about. These include the banks’ portfolios in: 1) Singapore mortgages, 2) oil & gas, and 3) commodities, ASEAN and developing Asia," said CIMB.

The report noted that all banks are equally exposed to Singapore mortgages, which make up is 19% of total loans for DBS, 26.4% for OCBC and 27.5% for UOB.

"Watch NPLs from high-end properties and small-format suburban units. Loss when default likely low. All three are almost equally exposed to mortgages at peak- prices (2013). UOB and OCBC are more exposed to high-end," said the report.

DBS is the most exposed to the oil and gas sector, while all three banks are mildly exposed to commodities, developing ASEAN and developing Asia.

"For DBS, we are most concerned about its lending to oil & gas SMEs, which tend to be the most highly geared. We deem UOB to be the most susceptible to the ongoing ASEAN slowdown, given its proportion of lending to the region. OCBC is in the middle ground, with neither the biggest nor the smallest exposure to the areas of concern, but a mix of exposure to all," said the report.

Advertise

Advertise