Chart of the Day: Oil and gas woes are taking their toll on Singapore banks

UOB and OCBC are particularly vulnerable.

Singapore's largest lenders are at risk due to their sizeable oil and gas exposures, according to a report by Moody's.

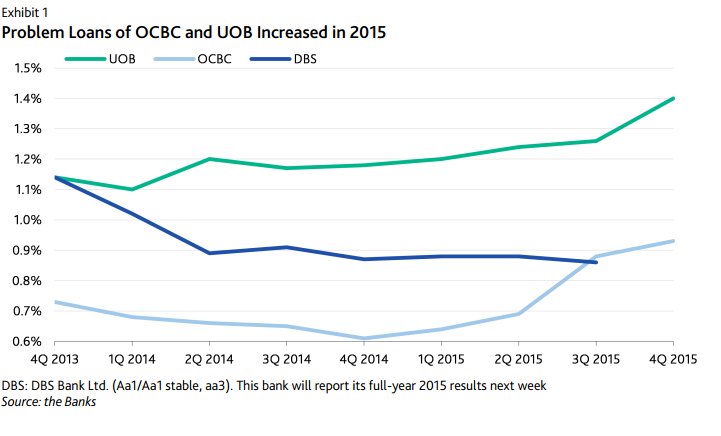

This chart shows that both UOB and OCBC saw an uptick in problem loans in 2015, after the oil price rout impaired some clients' ability to repay debt.

The chart, which was released before DBS reported results on Monday, shows that UOB's overall non-performing loan (NPL) ratio rose to 1.4% in 2015 from 1.2% in 2014, while OCBC's NPLs rose to 0.9% from 0.6% the previous year.

"We expect that the quality of OCBC's and UOB's loans will continue to deteriorate because of slowing economic and trade growth in Asia, and increasing stress for oil and gas borrowers in Singapore," Moody's said.

DBS' full-year results show that its total NPL ratio stayed stable at 0.9%.

Advertise

Advertise