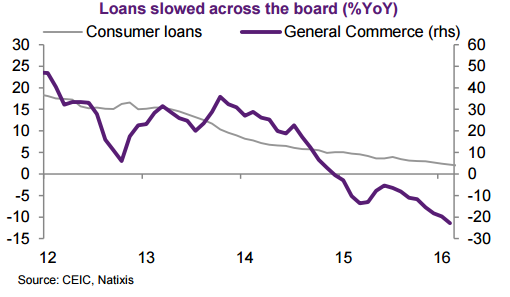

Chart of the Day: Singaporean bankers are struggling to sell loans as client demand wanes

Demand for both business and consumer loans is weak.

It’s getting tougher and tougher for bankers in Singapore to make clients sign up for loans, as companies look to pare down their debt and consumers tighten the purse strings in anticipation of weaker economic growth.

This chart from Natixis shows the unabated decline in both consumer and business loan growth, a leading indicator of economic activity.

“With foreign buyers missing and Singaporean consumers conservative, demand for loans slowed. And demand for credit is decelerating across the economy, ranging from consumer to general commerce,” said Natixis.

According to S&P, loan growth is expected to hover at 3%-5% for Singapore banks in 2016, following the modest 3.7% growth in 2015.

“Macro prudential measures to cool the domestic property market have also proven effective, with a corresponding decline in mortgage volumes. This has important revenue implications since interest income from loans accounts for some 60% of revenue in the banking system,” S&P said.

“Furthermore, if loan growth slows down, non-interest income from loan-related services would also weaken. Muted loan growth could result in pedestrian earnings growth, partially offset by expansion of net interest margins,” S&P added.

Advertise

Advertise