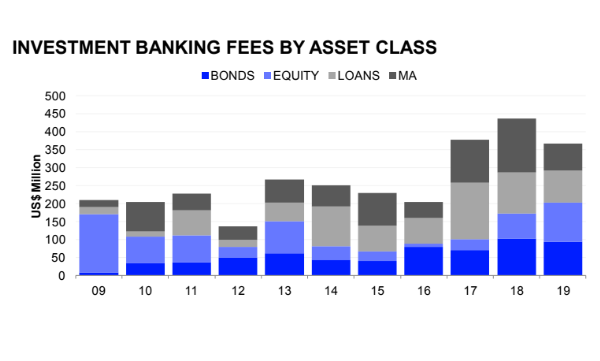

Singapore investment banking fees down 15.9% to US$366.3m

Advisory fees for M&A deals shrank 49% to US$76m.

Singapore investment banking activities generated US$366.3m in fees in H1 2019, marking a decline of 15.9% YoY, Refinitiv revealed. Advisory fees for completed mergers and acquisitions (M&A) shrank 49% to US$76m after a record-high in the H1 2018 (US$148.9m).

Meanwhile, underwriting fees in the equity capital markets (ECM) rose by 55.6% YoY to a 10-year high of US$108.1m, whilst fees from DCM underwriting decreased 8.4% to US$92.9m. Syndicated lending fees experienced a 22.8% decline to a three-year low worth US$89.3m.

DBS Group Holdings earned the most investment banking fees in Singapore for H1 2019 and topped the fee league table with a total of US$47.6m or a 13% share of the total fee pool.

Singaporean ECM proceeds reached US$ 2.9b so far this year, a 5% decrease YoY. Initial public offerings (IPOs) by Singaporean companies raised US$99.3m, down 81.2% in proceeds from the same period in 2018, making it the lowest first half period since 2015.

Meanwhile, follow-on offerings increased 47.7% from the comparative period last year, raising US$2.7b, the strongest period since the first half of 2013.

Morgan Stanley and Goldman Sachs are tied for first place in ECM underwriting rankings, each with a 26.6% market share and US$776.3m in related proceeds. DBS Group Holdings is in third place with US$346.8m in proceeds and 11.9% market share.

Primary bond offerings from Singapore-domiciled issuers declined 19.9% after a record start in 2018, with US$15.5b raised so far this year. Singaporean companies from the Financials sector captured 47.4% market share and raised US$7.4b, down 45.9% YoY.

DBS Group currently leads the Singapore bonds underwriting with US$3.2b in related proceeds, capturing 20.8% market share. OCBC comes at second place with US$2b in related proceeds corresponding to 12.9% market shares. UOB rounds up the top three, representing 10.8% of the market share and US$1.7b in related proceeds.

Advertise

Advertise