Here's how OUEHT outperforms peers in a tough environment

Its two upscale hotels are expected to bring a turnaround.

Research firm CIMB remains bearish on the hospitality sub-sector and expects it to only bottom out towards end-2017. However, underpinned by their respective strategic locations, it believes that OUEHT’s hotel properties should hold up better than those of its peers.

For 1H16, OUEHT recorded a 3.1% yoy decline in RevPAR, but still outperformed peers, CDREIT (-8.1% yoy) and FEHT (-3.9% yoy). Overall, the industry recorded a 2.5% yoy drop in RevPAR for 1H16.

CIMB notes that given the influx of supply, its upscale property Mandarin Orchard Singapore (MOS) registered a 4.4% yoy decrease in RevPAR in 1H16.

In line with its price leadership positioning along Orchard Road, as well as its desire to not spark a downward spiral in rates, the Manager maintained its strategy of maintaining room rates at S$250-260, at the expense of occupancy.

Occupancy came down to low-mid 80s (from high 80s), resulting in RevPAR decline.

Going forward, however, CIMB expects MOS to be more competitive following the completion of renovation works at 350 of its 430 guest rooms.

The asset enhancement initiative (AEI) for MOS will continue into 2016, and the refurbishment is funded by its Sponsor, OUE Ltd.

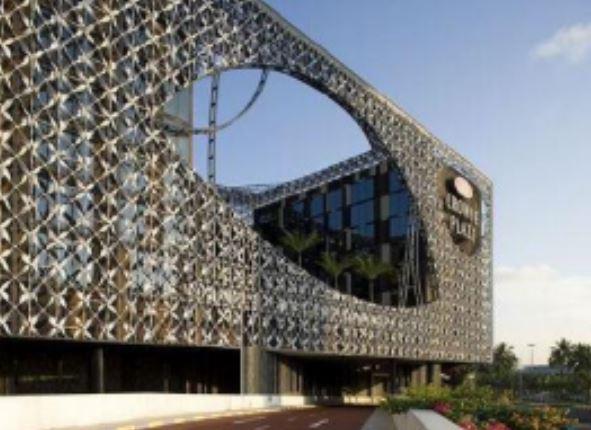

Meanwhile, Crowne Plaza Changi Airport (CPCA) continued to outperform, with RevPAR inching up by 0.4% yoy. Occupancy inched up 1% pt yoy to 91% while average room rate (ARR)

was flattish at the S$260-level.

According to CIMB, given the limited supply in Changi, CPCA remains a standout hotel within the locale.

CPCA is located at Singapore Changi Airport, with direct access to the passenger terminals and close to Changi Business Park.

Being the only 4/5-star business hotel in the proximity, CIMB said that it should also benefit from the expansion plans of Changi Airport.

Changi Airport has commenced development for Terminal 4 (target completion: 2017) and Project Jewel (target completion: 2018) as well as announced plans for Terminal 5.

According to Changi Airport Group, Terminal 4 is expected to provide additional capacity of 16m passengers p.a. and the planned Phase 1 of Terminal 5 is expected to add an additional capacity of 50m passengers p.a. in 2020 to Changi Airport’s current capacity of 66m p.a. Furthermore, the group expects Project Jewel to enhance Terminal 1’s capacity from 21m to 24m passengers p.a.

"This could mean Changi Airport could more than double its current passenger handling capacity by 2020," said CIMB.

Advertise

Advertise