Top five IT plays averaged total returns of 105.3% in 2019

The best-performing IT stock saw its total returns hit 154.3%.

The top five technology stocks averaged a total return of 105.3% over 2019, SGX reported. This brings their one-year total return to 88.7%.

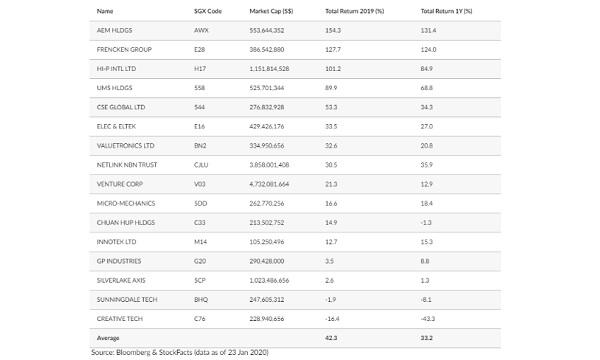

This was led by precision engineering firm AEM Holdings, with a total return of 154.3%. It is followed by Frencken Group (127.7%), Hi-P International (101.2%), UMS Holdings (89.9%) and CSE Global (53.3%).

Overall, the technology sector saw a total return of 39.4% in 2019. This is said to be the best performer in the local bourse.

The bourse lists at least 16 information technology plays with a market cap of more than $100m each, composed of 15 companies and one business trust. They averaged a total return of 42.3% over 2019, bringing their one-year total return to 33.2%.

The sector also drew the fourth highest net institutional inflows amongst sectors in SGX for the month, at $30.4m. It followed after financial services, real estate (REITs) and telecommunications sectors.

Advertise

Advertise