Chart of the Day: Massive fundraising deals revive Singapore's equity capital markets in H1

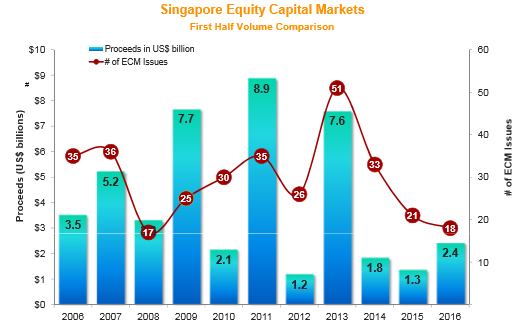

Proceeds hit a 2-year high.

Singapore-based companies tapped the equity capital markets and raised US$2.4 billion until mid-June, data from Thomson Reuters show. This marks a 79.3% increase in proceeds compared to the first half of 2015, during which companies raised a mere US$1.3 billion.

This also marks the highest amount of proceeds in two years. The increase was driven by BOC Aviation's US$1.12 billion IPO at the Hong Kong Stock Exchange, as well as two large IPOs at the Singapore Exchange Mainboard—Frasers Logistics and Industrial Trust's US$935.4 million IPO, and Manulife US REIT's US$493.2 million IPO.

Singaporean IPO accounted for 84.1% of the ECM market share in terms of proceeds. Follow-on offerings captured 15.9% of the Singapore ECM so far this year.

Morgan Stanley currently leads the ranking for Singapore ECM underwriting with US$ 354.2 million in related deals and captured 14.7% of the market share. Citi and BNP Paribas rounded out the top three bookrunners with 11.7% and 10.2% market share, respectively.

Advertise

Advertise