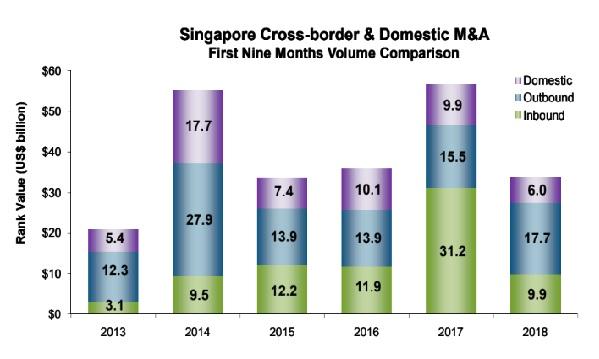

Chart of the Day: Outbound M&As jumped 13.7% to $24.15b in September

Germany is the most targeted nation for Singapore oversea deals.

This chart from Thomson Reuters shows that outbound Singapore outbound mergers and acquisitions jumped 13.7% YoY to $24.15b (US$17.7b) in September which is the highest first nine months period since 2014.

The firm noted that the real Estate industry is the most targeted sector as it captured 35.2% of Singapore’s outbound activity, with $8.46b US$6.2b worth of deals. Germany is the most targeted nation for Singaporean overseas deals YTD in terms of value as it accounted for 23.2% market share pushed by Temasek’s US$3.7b additional stake acquisition in Bayer AG.

Meanwhile, inbound M&A deals plummeted 68.1% to US$9.9b which is considered to be the lowest first nine months period since 2014. The firm noted that the high technology sector accounted for 25.5% of Singapore’s inbound M&A activities.

Advertise

Advertise