Chart of the Day: The strong greenback will have a terrifying effect on STI stocks

Investors need to be defensive this year, analysts say.

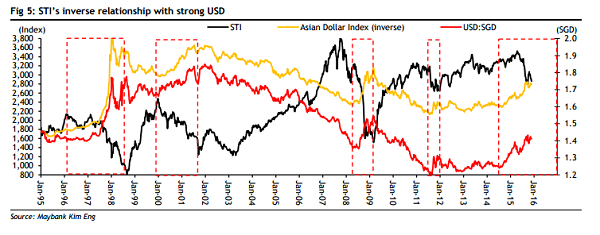

Singapore’s benchmark Straits Times Index (STI) has an uneasy relationship with the strong US Dollar. This chart from Maybank Kim Eng shows that in the last two decades, Singapore stocks have suffered whenever the greenback appreciated.

“During previous bouts of USD strength in the magnitude of 9-25% - Asian financial crisis, dot-com bust, global financial crisis and eurozone crisis - the STI gave up 29-55%. On average, a 1% appreciation of the USD is accompanied by a -2.9% move for the STI,” Maybank Kim Eng said.

The report noted that in this cycle, both have moved in greater lockstep: USD has appreciated 14% against the SGD while STI has fallen 14%.

Maybank Kim Eng noted that sectors which stand to benefit from a strong greenback include oil services, property developers and manufacturers, with manufacturers best poised to ride out USD strength.

On the other hand, retail REITs and consumer stocks with regional operations stand to lose most from USD strength, as regional currency depreciation would affect demand.

“Going by their tight inverse correlation, investors may do well to position defensively for 2016,” Maybank Kim Eng warned.

Advertise

Advertise