Singtel, DBS and CapitaLand top Singapore Governance and Transparency Index in 2019

Amongst REITs and business trusts, CapitaLand Commercial Trust dethroned CapitaLand Mall Trust.

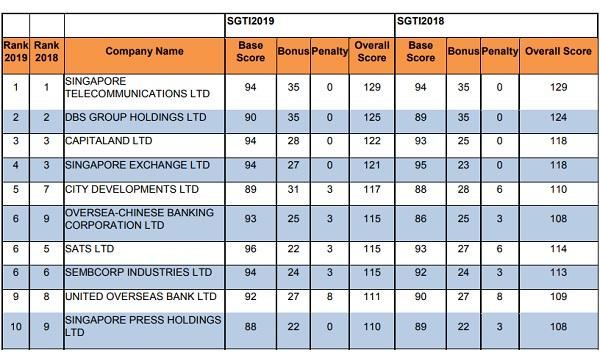

Singtel has retained the top position at the annual Singapore Governance and Transparency Index (SGTI) by CPA Australia, National University of Singapore (NUS) and the Singapore Institute of Directors (SID), with an overall score of 129 points.

DBS Group followed at second place with a score of 125, up 1 point from 2018. CapitaLand and Singapore Exchange also saw their scores improve to 122 and 121, respectively, whilst City Developments made it to the top five for the first time since SGTI started. Oversea-Chinese Banking Corporation (OCBC) moved up to the sixth position, up from ninth place in 2018.

The index assesses companies on their corporate governance disclosure and practices, as well as the timeliness, accessibility and transparency of their financial results announcements. The SGTI 2019 scores constitute base scores, bonuses and penalties awarded in accordance with corporate governance disclosure performances.

It ranked 578 Singapore-listed companies and 46 REITs and business trusts that released their annual reports by 31 May. Overall, the average score for companies is 59.3, an increase of 3 from 2018, where the mean scores have improved consistently from 31.5 in 2011.

Also read: Singapore firms' leadership boosted by board and audit upgrades

Additionally, companies continued to receive greater bonuses at 8.6, up 0.9 points from 7.7 in 2018. Penalty scores rose 0.6 points to 10.8 in 201 as well.

In the REIT and business trust category, CapitaLand Commercial Trust overtook CapitaLand Mall Trust to clinch first place. CapitaLand Mall Trust fell one spot to second place, whilst Ascott Residence Trust maintained its third position.

Overall mean score climbed 4.1 points to 78.6 from 74.5 in 2018. SGTI noted that its indicated that REIT managers are still striving towards greater disclosure. The continued disclosures and audit reviews of significant interested person transactions scored 76%. Additionally, 96% of companies disclosed the base fees of their trust managers receive.

Also read: REITs and business trusts pump up disclosure practices

Furthermore, SGTI also revealed that stakeholder engagement edged up 15 ppt to 53% from 38% of companies in 2018. The improvement was thanks to the 70% disclosure of health, safety and welfare policy for employees which almost doubled from 36% in the previous year. Around 70% of companies have pursued efforts in making environmentally friendly value chains. This figure went up as compared to 43% in 2018.

Disclosure of shareholder rights also rose 3 ppt YoY to 72%. This is due to the greater participation by shareholders in approving the remuneration of non-executive directors, which rose 26 ppt to 88% from 62%. The boost also came as more companies abide by the requirement for directors to be subjected to re-election at least once every three years.

Advertise

Advertise