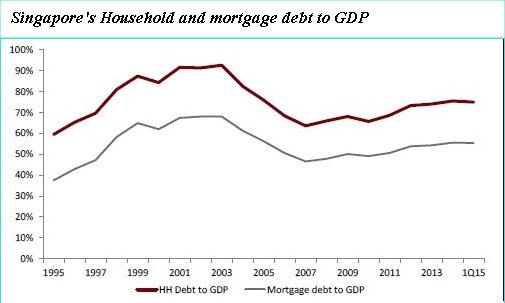

This one chart may totally dampen hopes for more relaxed cooling measures

Indicators simply prove measures have been effective.

Developers and market players have been lobbying for a relaxation in some of the property cooling measures, such as removal or tweaking of transaction costs such as the Additional Buyers Stamp Duty (ABSD) and Sellers’ Stamp Duty. Going into 2016, CIMB analyst Lock Mun Yee and team think the possibility of a wholesale removal remains slim at this juncture given the current economic turbulence and would likely need to see more weakness before any action is taken. She adds that the latest macro indicators show that the property cooling measures have been effective.

"At the peak of the cycle, household debt to GDP stood at a high 92.6% in 2003. As at the beginning of 2015, it was down to 75%. Meanwhile, mortgage debt to GDP was at 55.4% compared to a high of 55.6% at end-2014 and 68.1% in 2003. These ratios show that the measures taken are having a restraining effect but, we think, it has by no means corrected sufficiently to buffer another round of asset price reflation," she said.

Advertise

Advertise