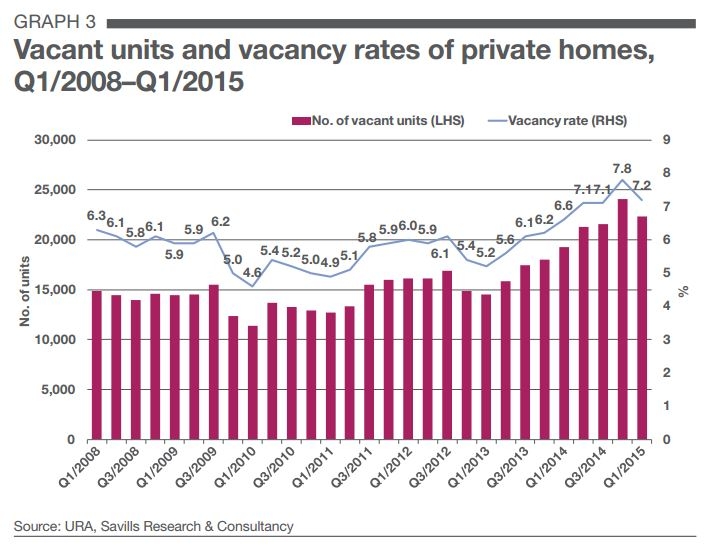

Chart of the Day: Check out the steady rise in home vacancy rate since 1Q2013

Despite the slow pace in stock build-up.

According to Savills, in the first quarter, the current stock of private residential units increased at a slower pace of 0.9% QoQ to 311,635 units. This is in contrast to the 1.5% QoQ average growth seen in the preceding six quarters.

However, the supply of new private homes should step up for the remainder of 2015. Official statistics show that 19,018 completed units are expected to come on-stream from Q2-Q4/2015.

Here's more from Savills:

To understand the enormity of the situation, we look to Q2 to Q4 of both 2014 and 2013 for comparison. For these two periods, the supply for the remaining three quarters of their respective years was just 15,827 and 10,483. The new supply coming on-stream for the remainder of this year is

20% and 81% higher than the similar period of analysis for 2014 and 2013 respectively, presenting a great challenge for the leasing market to be able to absorb the new completions.The leasing market in the CCR is becoming competitive as some larger projects have received the Temporary Occupation Permit (TOP) in Q1/2015. Among the more notable ones are OUE Twin Peaks, RV Residences and Stellar RV which together added 830 units to the previous quarter’s stock.

The completion of these large projects has placed further pressure on rents of other developments in the CCR. If we consider the 1,715 units at the recently-completed D’Leedon, a substantial part of which is still looking for tenants, the pressure is even greater.

The situation is not helped on the demand side as companies have been reducing the rental budget for their expatriate staff. With crimped rental budgets, expatriates are beginning to venture out to the non-CCR areas which can offer a more spacious abode than prime locations, for the same rent.

Although demand had been weak, occupancy improved marginally as vacancy rates of private homes slipped by 0.6 of a ppt to 7.2% from the previous quarter. Nevertheless, this still translates to 22,346 vacant residential units, a huge opportunity cost.

The improvement in the occupancy is due more to the slower rate of completions rather than increasing demand. Unfortunately, as the pace of supply is expected to step up for the remainder of this year, the vacancy rate is likely to increase again.

Advertise

Advertise