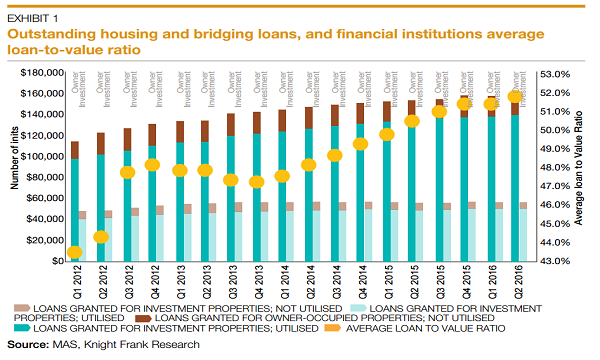

Chart of the Day: Check out the uptrend in the average property loan-to-value ratio

It graduated from a previous low of 47.2% in 4Q13.

The banking industry's average property loan-to-value (LTV) ratio has been on a steady increase for the past quarters.

According to data from MAS and KnightFrank, average property LTV ratio reached 51.7% as at mid-2016, gradually escalating from the previous low of 47.2% in Q4 2013.

However, a November 2016 MAS report said that the risk profile of housing loans has improved, as most loans have LTVs of 80% or lower. Only a negligible share of housing loans is in negative equity.

More so, the debt servicing ratios of households have also improved since the introduction of the total debt servicing ratio in June 2013.

Advertise

Advertise