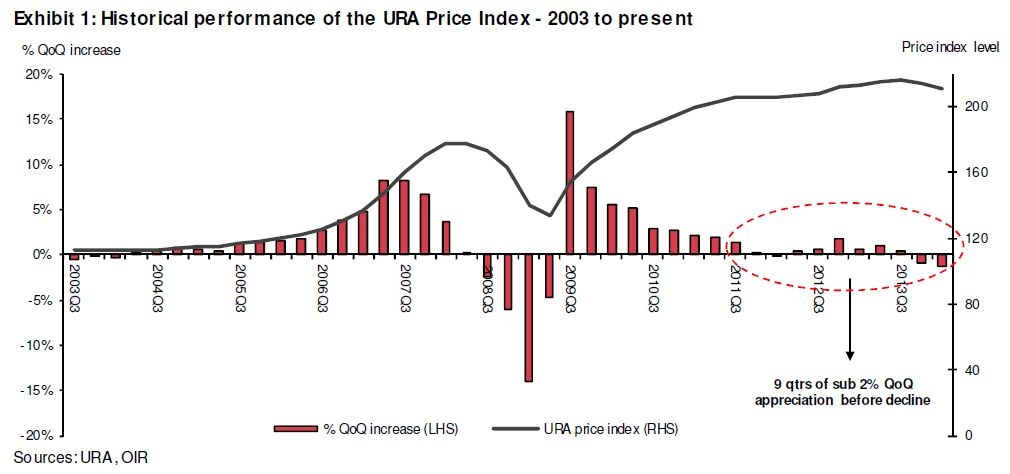

Chart of the Day: This graph shows just how much home buyers are scared of taking up units

Price index is going down, down, down.

Singapore's residential property market is predicted to be on its toe for a longer time as the moods of buyers became more gloomy.

According to OCBC, they saw the URA residential price index fall 1.3% and 0.9% in 1Q14 and 4Q13, respectively, after nine quarters of sub-2% appreciation before that.

Here's more from OCBC:

The mood of the market has been increasingly cautious after the latest TDSR requirements and we believe that significant headwinds, i.e., a physical oversupply situation over FY14-16 and an anticipated interest rate uptrend after mid-FY15, will likely keep the market on its back foot.

Including HDB, DBSS and EC completions, we anticipate that 50.0k, 49.7k and 73.6k homes will come into the physical supply in FY14, FY15 and FY16, respectively.

Assuming a 6.0m population target by 2020 from the latest Population white paper, we forecast average population growth at ~86k individuals per annum from 2014-20. Assuming a conservative 3 persons per household, this translates to an incremental demand of ~29k physical homes per year, which points to a fairly clear physical oversupply situation ahead.

Advertise

Advertise