Chart of the Day: Here is Singapore's 5-year property cooling measure timeline you should see right now

And it's bound to go on and on.

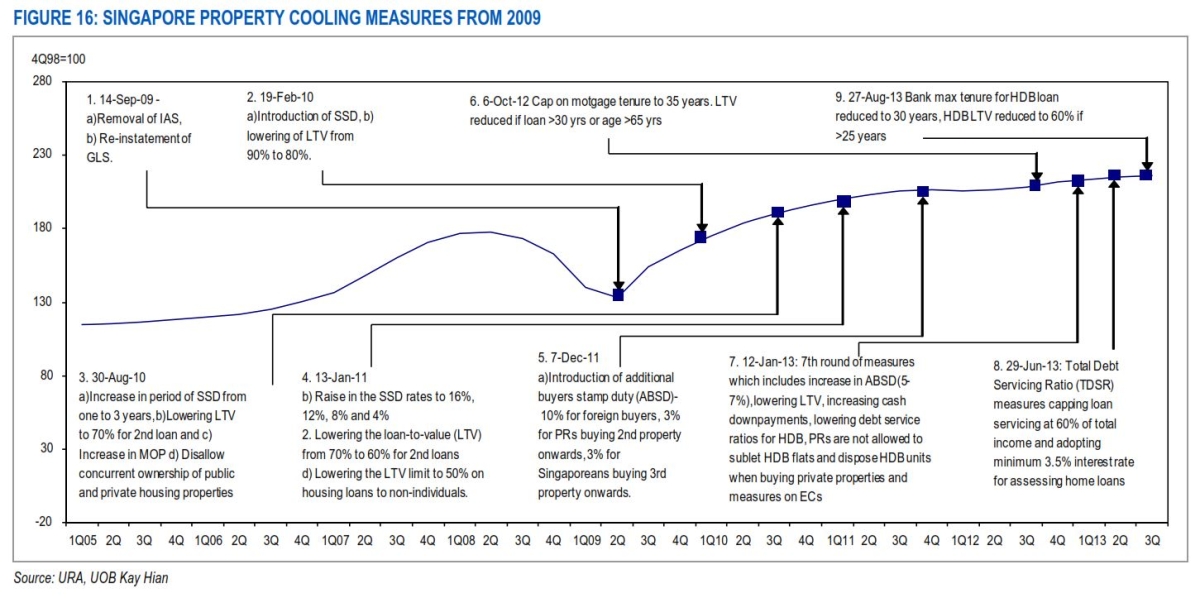

It has been 5 years since the Singapore government started to clamp down on the property market with cooling measures that were expected to pull prices down, and it's only now that these new rules are starting to sink its teeth.

According to UOB Kayhian, altogether, the government has introduced nine rounds of property cooling measures from 2009. However, the measure that finally cooled property prices was the eighth round with the introduction of the total debt servicing ratio (TDSR) framework on 29 Jun 13.

Here's more from UOB Kayhian:

This ensures that banks take all of a borrower’s outstanding debt obligations into account when granting property loans. The Monetary Authority of Singapore (MAS) expects banks, when granting new property loans, to ensure that borrowers’ total monthly repayments do not exceed 60% of monthly income for all non-property and property loans.

Other refinements include: a) applying the higher of current interest rates or a medium-term interest rate of 3.5% for residential and 4.5% for commercial properties, b) applying a 30% haircut to all variable income (eg bonuses) and rental income, and c) applying haircuts of up to 70% on the value of financial assets pledged to obtain property loans and amortise this value over four years in order to convert them into “income streams”.

With slowing sales and moderating property prices, we believe the peak of policy measures is behind us.

While the government has been tapering the supply side since the end of last year, we believe the trigger for easing demand-side policy measures would be a correction of about 10% in property prices.

Recall that more than 90% of the Singapore population own homes in Singapore and rely on property as a key wealth source. A 10% broad-based correction would mean that certain projects seeing over a 20% correction could see a negative equity build-up, a scenario that is highly undesirable as we approach the next general elections.

The government, in the budget speech, also mentioned that they are not engineering a hard landing. We believe a 10% correction would be the threshold for the government to start rolling back some demandside measures.

Advertise

Advertise