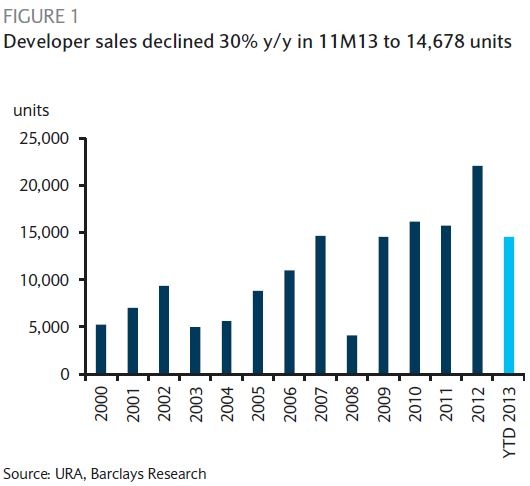

Chart of the Day: Singapore developer sales dropped a massive 30% to 14,678 units

Will this help roll back tightening measures?

According to Barclays, the recent softening of the residential market in terms of volumes and prices and a significant cutback in the government’s land sales programme might have raised hopes that the government will unwind its existing tightening policies for property.

"We believe this is premature as prices are still elevated, and we believe a 10-15% correction is warranted before the government rolls back policies that took four years to have an obvious impact," Barclays said.

Here's more from Barclays:

We would still prefer to wait to become more positive even if the government decides to roll back the measures as historically home prices have continued to slide on weak fundamentals, which we expect to prevail until 2015 or even 2016.

Developer sales fell 30% y/y in the 11 months to November 2013 to 14,678 units from 20,880 units sold in 11M12. We expect December volumes to have declined sequentially, resulting in full-year sales of 15,500 units in 2013 (-30% y/y).

We expect 2014 volumes to be worse as the Total Debt Servicing Ratio (TDSR) rules in place since June 2013 continue to bite, and also as buyers become cautious due to the looming oversupply situation.

Advertise

Advertise