Chart of the Day: Take a closer look at Singapore's crowded land bidding scene

Developers are buying land despite depressed home prices.

The current property price downcycle isn’t keeping residential developers from snapping up sites offered for sale under the Government Land Sales (GLS) Programme.

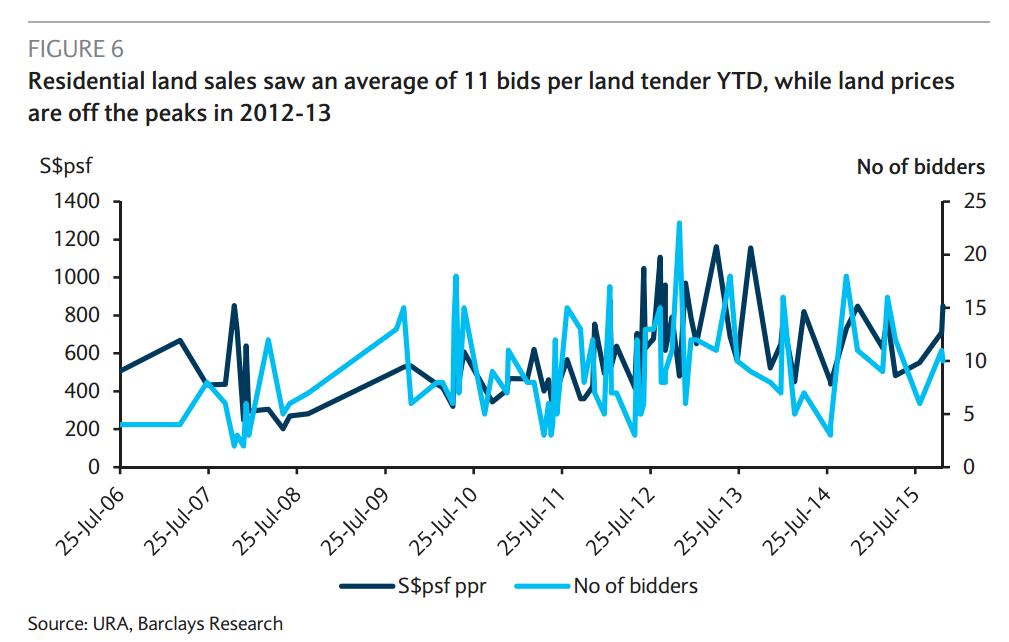

This chart from Barclays shows that land sales remain robust this year despite Singapore’s prevailing property cooling measures.

For instance, an attractive site in Lorong Lew Lian attracted 11 bids after it was triggered for sale from the Reserve List of the GLS on November 5.

The site was won by City Developments and joint venture partners Hong Leong Holdings and TID for a total price of $321m, or $710psf ppr.

Another land sale in Alexandra View also drew ten bids with the top bid at $851 psf ppr, proving strong developer demand for well-located sites.

Although land prices have fallen from their peaks in 2012 and 2013, Barclays noted that bids remain competitive with extremely tight margins. This reflects the 8% slide in the private home price index.

“This crowded bidding scene at the GLS highlights the need for Singapore developers to replenish depleting landbanks amidst declining land sources (GLS reduced the Confirmed List), despite the ongoing subdued markets,” said Barclays.

Advertise

Advertise