Chart of the Day: Which local developers are most exposed to China headwinds?

Equities might take a hit as slowdown bites.

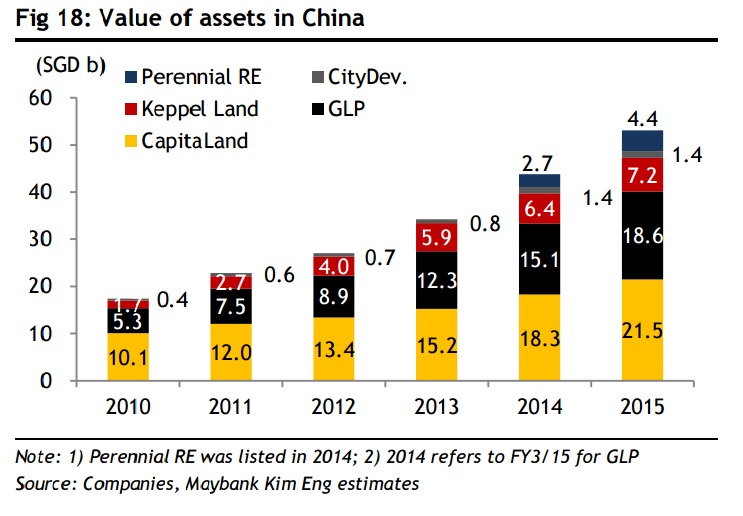

Singapore's largest property developers have aggressively increased their Chinese assets in the past five years, as evidenced by this chart from Maybank Kim Eng.

In 2010, Capitaland had only 32% of its assets in Mainland China; in 2015, that figure stood at 47%. The increase was even more steep for Global Logistics Properties, whose share of total assets in China rose from 35% in 2010 to 59% iin 2015.

Meanwhile, almost half or 48% of Keppel Land's assets are located in China in 2015, as opposed to just 20% in 2010. City Developments is the least exposed among the developers, with Chinese assets making up only 7% of its total assets.

According to Maybank Kim Eng, Singapore's large exposure to China might bring headwinds for equities, particularly for developers which have "disproportionately large" exposures.

"Returns on China assets are generally not impressive, across the sectors. CapitaLand alone seems to do just fine in part because of its early entry. Concentration risks for the property sector bear watching. More than 36% of the sector’s assets are now in China,” said the report.

Advertise

Advertise