Chart of the Day: Big ASEAN value stocks hit 36.1% in total returns over the past 3 years

DBS held a market capitalisation of $62.4b.

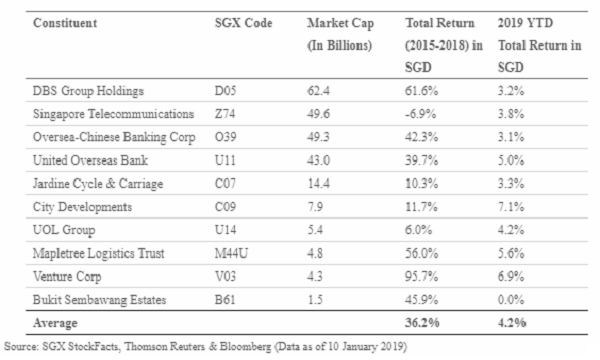

This chart from Singapore Exchange (SGX) shows the performance of the 10 SGX-listed stocks of the FTSE Value-Stocks ASEAN which averaged a 36.1% total return in SGD terms over the last three years.

DBS Group Holdings led the pack with a market capitalisation of $62.4b, followed by Singtel ($49.6b) and Oversea-Chinese Banking Corporation (OCBC) with $49.3b. Rounding of the group is Bukit Sembawang Estates with a market capitalisation of $1.5b.

In terms of the highest total returns within between 2015 and 2018, Venture Corporation racked in 95.7% in total returns in SGD terms, followed by DBS (61.6%) and Mapletree Logistics Trust (56%).

“With the exception of Venture Corporation, all 10 of the stocks were recipient of capital inflows from retail investors in 2018, with net inflows totalling $2.7b,” SGX noted.

The 10 stocks have also averaged 4% gains in the 2019 YTD.

Advertise

Advertise