Returns of top 20 stocks dropped 3.8% YTD

Stocks were hit by the 30% fall in crude oil price.

The average total returns of the local bourse’s 20 most traded stocks is at -3.8% in 2020 YTD, according to an SGX report. This came after the 30% plunge in oil price on 9 March, which resulted in the 4.3% fall of the Straits Times Index (STI).

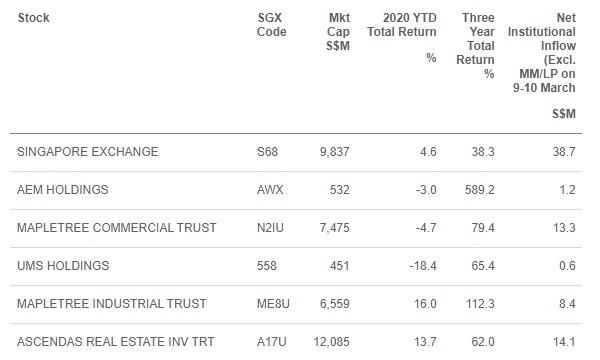

Yangzijiang Shipbuilding saw the largest decline as its returns hit -22.3%, followed by Genting Singapore at -19.6% and UMS Holdings at -18.4%.

Other stocks that posted declines are Singapore Press Holdings, AEM Holdings, Mapletree Commercial Trust (MCT), Mapletree North Asia Commercial Trust, Frasers Logistics and Industrial Trust, Ascott Residence Trust, CapitaLand Mall Trust, Wilmar International and Jardine Strategic Holdings.

However, these stocks were still able to generate net institutional flows in 2020 YTD. SGX generated the highest amount at $38.7m, followed by Ascendas Real Estate Investment Trust at $14.1m, MCT at $13.3m and ST Engineering at $5.2m.

Advertise

Advertise