Which stocks beat the benchmark STI in September QTD?

Wilmar's YTD returns hit 27.2%.

As many as 11 out of the 30 stocks in the STI and five stocks in the STI Reserve List defied the gloomy trading environment to generate positive total returns in September, according to a report by the Singapore Exchange (SGX).

This comes even as the benchmark Straits Times Index (STI) declined 4% in total returns in the September QTD, attributed to the ongoing moderation of the global growth outlook and the impact of interest rates.

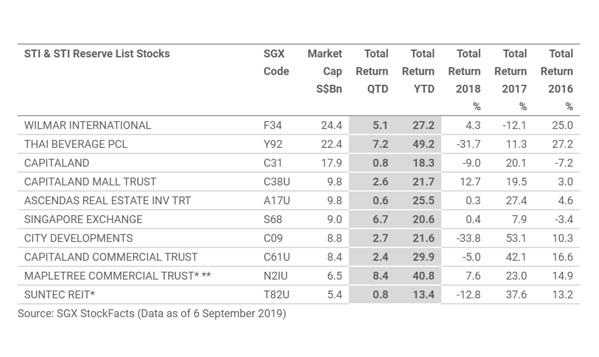

Of these stocks, Mapletree Commercial Trust registered the highest total return percentage QTD at 8.4%, whilst Thai Beverage recorded the highest total return percentage YTD at 49.2%. Meanwhile, Wilmar International is the largest company in terms of market capitalisation that registered gains during the period, with a total return of 5.1% QTD and 27.2% YTD in September.

The 10 largest stocks by market cap that added to their H1 2019 gains in QTD terms are all STI or STI Reserve List stocks: Wilmar, Thai Bev, CapitaLand, CapitaLand Mall Trust, A-REIT, SGX, City Dev, CapitaLand Com Trust, Mapletree Com Trust, and Suntec REIT.

Also read: S-REITs drew $311.7m net inflows in 8M19

The US Federal Reserve cutting interest rates by 25 bps on July 31 following nine successive hikes in a move that impacted banks and real estate stocks, according to SGX. The largest capitalised 100 bank stocks across the world generated a median total return of 6.8% in the first nine months of 2019, down from the median total return of 23.6% over the same period in 2018.

In Singapore, DBS Group Holdings, Oversea-Chinese Banking Corp (OCBC) and United Overseas Bank (UOB) averaged a 6.2% total return as of 6 September; whilst the iEdge SG Real Estate 20 Index generated a 21% total return, and the iEdge S-REIT Index generated a 25.5% total return, SGX noted.

Focusing in on UOB, SGX reported that the bank recorded a net institutional outflow of $475m, whilst UOL Group has seen a net institutional inflow of $27m. In contrast, last year, coinciding with rising interest rates, UOB saw net institutional inflow of $260m, whereas UOL Group saw net institutional outflow of $99m. UOL Group has generated a total return of 23.9% as of 6 September, whilst UOB generated a total return of 8.9%.

Advertise

Advertise