Singtel to receive boost as contributions from associates recover: analyst

Bharti’s losses are expected to narrow to $345m by FY20.

Singtel will see better days soon as profit contributions from its regional associates, particularly Bharti, recover and boost the telco’s struggling bottomline, according to analysts.

Also read: Singapore telcos brace for higher capex amidst 5G rollout

In Q1, Singtel profits crashed 35% YoY to $541.1m mainly due to losses from the operations of its Indian associate, Bharti Airtel. Post-tax associate contributions hit $273m, down 18% QoQ and 29% YoY, following a $119m loss Bharti Airtel, an analysis by DBS showed. Bharti currently acts as the biggest overhang on associate recovery, booking losses of $511m in FY19 from a profit contribution of $216m in FY18, DBS analyst Sachin Mittal observed in a report.

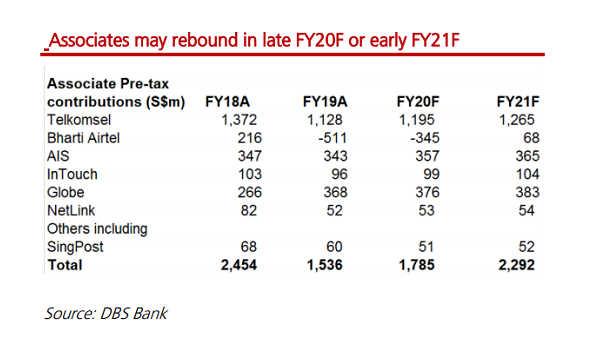

However, the loss is tipped to narrow to $345m by FY20 and eventually bounce to $68m by FY21, according to DBS. “We expect losses to narrow in FY20F vs FY19 with potential refinancing of debt through the rights Issue and Bharti’s ongoing “War on Waste” programme,” said Mittal.

“Associates may rebound in late FY20F or early FY21F,” he said. In particular, Indonesia’s Telkomsel is expected to see low-single-digit growth with FY20 pre-tax contributions of $1.19b which will rise further to $1.27b by FY21 as it navigates increasing competition in Java and ex-Java. AIS and Globe are likely to rake in $357m and $376m in FY20 pre-tax contributions which will rise to $365m and $383m by FY21.

Also read: Singtel's dividends from associates may fall 22.58% to $1.2b in FY2020

“We expect Singtel to record ~4% YoY growth in core-EBITDA, largely due to the impact of SFRS-16, which eliminates ~$420m in operating lease expenses from operating costs,” added Mittal. Without the impact of SFRS-16, however, core-EBITDA, is likely to decline for another year in FY20 due to the weakening Australian consumer and enterprise segments.

“Stabilisation and further improvements in the Singapore enterprise segment should help offset some of the weakness in Singapore consumer and Australian business,” he said.

In a separate report, OCBC Investment Research (OIR) has expressed more optimism over Singtel’s prospects after Telstra raised prices, which Optus followed in April and correspondingly adjusted its SIM BYO plans upwards. These developments bode well for ARPU and mobile service revenue moving forward. “In India, we understand that Vodafone Idea has started to follow Airtel in removing its low-valued post-paid plans,” OIR added.

Advertise

Advertise