AutoWealth launches robo-advisor financial investment service after multi-million seed round valuation

It mimics a human financial planner, and it is set to disrupt the S$594 billion financial advisory market in Singapore.

When 29-year-old Ching Kai Chen first tried the beta test version of AutoWealth, a robo-advisory platform that doles out financial investment services, he was impressed by its combination of convenience and intelligence.

“Investing can take a substantial amount of time – stock picking, monitoring individual company results and getting the analysis correct. I wanted a simpler and less risky way of investing, and AutoWealth provided the right product for me,” he says.

“The investment is already well diversified, being a portfolio of ETFs and bonds. I can just go ahead with my daily life, with minimal monitoring from me, and still benefit from gains from general market growth.”

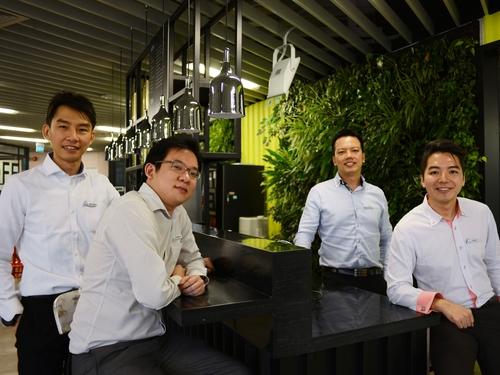

Following a year of intensive beta testing, AutoWealth Pte Ltd officially launched in August. It comes after an exciting run-up in the past year, which includes a successful NUS Enterprise incubator program performance, the closing of its seed round at a multi-million valuation, and the onboarding of hundreds of clients since it received a Financial Advisor’s Licence from the Monetary Authority of Singapore (MAS).

Noel Lee, COO, AutoWealth has high hopes that more customers and investors will be piqued by the robo-advisory service that basically mimics a human financial planner but promises a faster, smoother and less costly service.

AutoWealth created an automated process that cuts down on the processing time and middleman profits whilst still giving customers precise recommendations on the ideal composition of their investment assets, the initial sum to invest and the periodic investment installments.

“For many years, we saw the struggles faced by our parents’ generation and our peers not accumulating sufficient wealth for their financial commitments such as weddings, housing or even children’s education. This is largely because they are earning very low net returns from fixed deposits, mutual funds or when they invest through financial planners,” says Lee, recounting what led him and co-founder and CEO Ow Tai Zhi to establish the start-up.

“After seeing all these pains, we resolved to create a high returns, low cost product that can finally help any Singaporeans accumulate enough wealth to meet their financial obligations.”

Lee reckons that unlike human financial planning, AutoWealth’s robo-advisory platform automates the entire process to make it simpler, more convenient and hassle-free. Customers start by taking a two-to-three-minute online questionnaire, which feeds into the robo-advisory system. This helps create a full picture of each customer’s financial situation, risk profile and financial goals.

AutoWealth’s proprietary algorithm, which is based on automated advisory technologies already widely used in Western countries, analyses the customer’s answers and recommends a tailored investment portfolio.

Lee says AutoWealth stands above competing services because of its topnotch returns and shaved costs. He claims its investment strategy generates investment returns that typically outperform 80-90% of all mutual funds with a similar investment mandate. From June 2016 to June 2017, AutoWealth investments posted 10.4% returns net of fees.

Meanwhile, its platform technology automates 80% of the financial advisory and investment management process that enables them to offer low fees that are 25% that of traditional financial services, or at 0.50% per annum on the assets under advice and US$18 per annum platform fee. In comparison, Lee says traditional investment through mutual funds typically comes with excessive sales charges, annual management fees and other hidden charges that stacks up to about 2% per annum on average.

“Combining higher returns with a lower fee structure, our clients are able to take home way higher net returns compared to mutual funds or financial planners,” says Lee.

Whilst robot automation brings major improvements to the AutoWealth investment process, there is still a human touch. Customers can meet face-to-face with one of the start-up’s financial advisory representatives, all of whom are licenced by MAS, to ask more questions and to open their AutoWealth account through which portfolio performance can be monitored on demand.

“We believe a hybrid model will particularly address the needs of the older population, whom we also desire to serve,” says Lee on the decision to support the robo-advisory platform with human agents.

After its official launch, AutoWealth is setting its sights on getting the word out to more Singaporeans through more roadshows and seminars, including investors that are not as familiar with digital technology. The start-up is also engaging regulators and industry bodies to further nurture the robo-advisory industry.

“AutoWealth’s vision for robo-advisory in Singapore is to have a few strong robo-advisors bringing good investing to the masses. For a very long time, we saw people around us failing to achieve their financial dreams due to inadequate financial planning and the lack of good low-cost investment offerings,” says Lee.

“Our aim is to make all investors in Singapore aware of the high performing yet low-cost alternative to mutual funds and unit trusts.”

Advertise

Advertise