iPay you now: Singapore's millennials demanding mobile wallets

Millennials demand faster and easier ways to pay.

It seemed awkward at first, as J.D Power Director Gordon Shields recalls it, having to pay using his phone at a local supermarket in Singapore. He tells how the checkout assistant confusingly shouted "Apple Pie, Apple Pie" across the store when he handed her his iPhone in an attempt to pay using the mobile app Apple Pay at that time.

"It makes you wary of trying the payment option again," he says, although the cashier team finally managed to make it work.

Launched in just May by Apple and followed in June by Samsung and Android, mobile wallets have now been adopted by one in four Singaporeans but one in three millennials. Shields said that as mobile wallets allow transactions to be made quickly and also for notifications to be registered on the mobile phone, this allows cardholders to have access to their most recent account activities, as well as to receive any alerts or messages from the card issuer on their account.

“It also helps to improve overall transparency over the account and can work to provide greater control on spending – either for someone who wants to manage their spend on certain categories, or others who may be working towards a certain cashback or rewards spend target,” he says.

He adds, “In essence, as consumers like to have greater transparency over their accounts and prefer quicker access and control, without going through certain hurdles with OTPs or hard tokens, mobile wallets offer a good solution. However, the barriers to usage are multifold, including acceptance level across merchants, perception of fraud or misuse by cardholders, as well as the simple awkwardness for some users when trying the first time.”

Contactless payments using mobile phones in Singapore have gained popularity only this year with more than 30,000 retail points in Singapore have enabled payment through apps such as Apple Pay, Samsung Pay, and Android Pay.

"We expect overall usage to increase, as people move more to having their cards and loyalty programmes on the smartphone rather than in the physical wallet. However, how fast the growth will be still remains unclear," he explains.

A certain way to gauge how fast mobile wallet will gain more traction is by looking at how banks in Singapore embrace the innovation. OCBC Bank says it has seen over 35% growth in contactless payments for the past year.

"It was an easy decision to embrace digital wallets, be it Apple Pay, Samsung Pay or Android Pay, as we want to make this convenient payment method available to as many OCBC customers as possible," says OCBC lifestyle financing group head Desmond Tan.

For Usman Khalid, Standard Chartered Singapore’s payments head, mobile wallets dissolve friction from payments.

“Customers have strongly embraced these platforms as part of their lifestyles, with our customer engagement metrics showing a positive increase. We are also seeing significant growth in customers’ overall contactless spends,” he notes.

Standard Chartered says it is the only international bank in Singapore to have launched services in three mobile wallets for its clients. As the technology cuts across all three mobile phone operating systems, Khalid said they have seen consumers use mobile wallets for small ticket size “everyday spend” categories such as supermarkets, coffee shops and fast food restaurants.

Meanwhile, Maybank Singapore Community Financial Services Head Choong Wai Hong notes that their card members have the option to pay using Samsung Pay app. More than the ease of using one, Choong says customers could rely on the added security the technology offers.

"The mobile wallet is also safe to carry and use. While some consumers may forget to bring their cards or wallets when leaving home, they rarely forget their mobile phones. Hence it provides the added comfort that they have their wallets with them even when they forget to bring their physical cards," he underscores.

Choong stresses that one challenge for banks is to get more customers to adopt the new mode of payment.

"Another challenge is that not all models of mobile handsets support the respective mobile payment apps, so we have seen cases where customers want to embrace this form of digital payment, but their current mobile handsets are not compatible," he says.

Out of all the apps, only Android Pay can be used by older NFC-enabled mobile phones. Samsung Pay and Apple Pay support only the latest handsets of their respective brands.

But for users who had positive experience using mobile wallets, Choong acknowlodges it is likely that there will be high penetration of mobile wallets in the long run.

"In the short to medium term, what’s more likely is the scenario of consumers using a combination of physical card payment and mobile payment. Furthermore, physical cards are still necessary for payment in other countries where there is no or low mobile payment acceptance," he says.

OCBC’s Tan has the same sentiment, adding that financial institutions should speed up their innovation process or risk becoming a laggard in this rapidly-changing world of payments.

“We are expecting digital wallets to lead the next revolution in the rapidly growing world of payments,” he foresees.

Some banks have gone so far as creating contactless ATMs. UOB, aside from launching Asia Pacific’s first contactless payment option through its UOB Mighty app, has promised to roll out 60 contactless ATMs around the city-state by January next year. It ambitiously eyes to replace all of its 634 ATMs with NFC-enabled ones by the end of 2018.

UOB Head for Personal Financial services Dennis Khoo says the bank even worked with partners to introduce contactless mobile payments at all MRT stations in Singapore.

“This means that UOB cardmembers can now simply top up their EZ-Link cards at any General Ticketing Machine with a tap of their smartphone,” he notes. “It is as important to grow acceptance points in areas that are most relevant to our customers’ lives, from retail and groceries to transit. “

He, like Shields, believes that it will be millennials who will advance the adoption of mobile wallet technology in Singapore.

“We have noticed that they are generally early adopters of new innovations such as contactless mobile payments. As they will soon make up the largest demographic of consumers in Singapore, it is natural that they will continue to influence and shape the consumer landscape in Singapore,” he concludes.

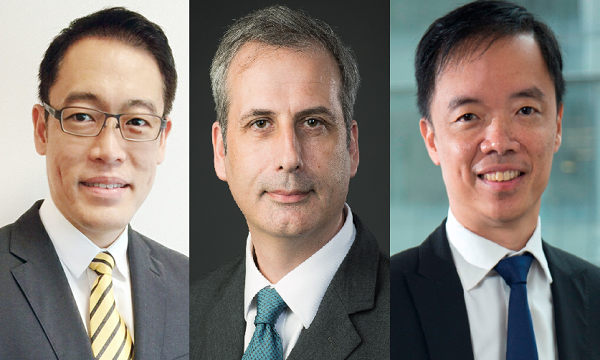

In photo: (L-R) Maybank Singapore Head of Community Financial Services Choong Wai Hong, J.D Power Director Gordon Shields, UOB Head for Payments Dennis Khoo

Advertise

Advertise