Daily Briefing: Carousell to launch digital wallet; Singapore-grown SEA's e-commerce losses doubled

And here's what you could have missed on Noble's debacle with shareholders and creditors.

From Reuters:

Noble Group's downfall from a US$11b Asian commodity titan into a penny stock worth US$80m has been mired with heated arguments between the company and shareholders. Shareholder meetings and legal rulings in the next few weeks will then decide its fate.

"Leading the resistance is Abu Dhabi-based Goldilocks Investment Co. Ltd, which holds 8.1% in Noble. Goldilocks has filed complaints and lawsuits against the restructuring plans, arguing they protect creditors at the expense of shareholders.

Goldilocks is Noble’s third-biggest shareholder after Elman and China Investment Corp, which has a 9.5% stake.

It’s not just shareholders who are unhappy, though. One of Noble’s business partners, Indonesian coal miner PT Atlas Resources (ARII.JK), has also filed lawsuit against Noble and its chief executive William James Randall, alleging it was given false information related to asset sales.

Shipping Indonesian coal to buyers in Asia is the biggest remaining business at Noble, which has said it plans to resist any and all allegations or claims made against it."

Read more here.

From Deal Street Asia:

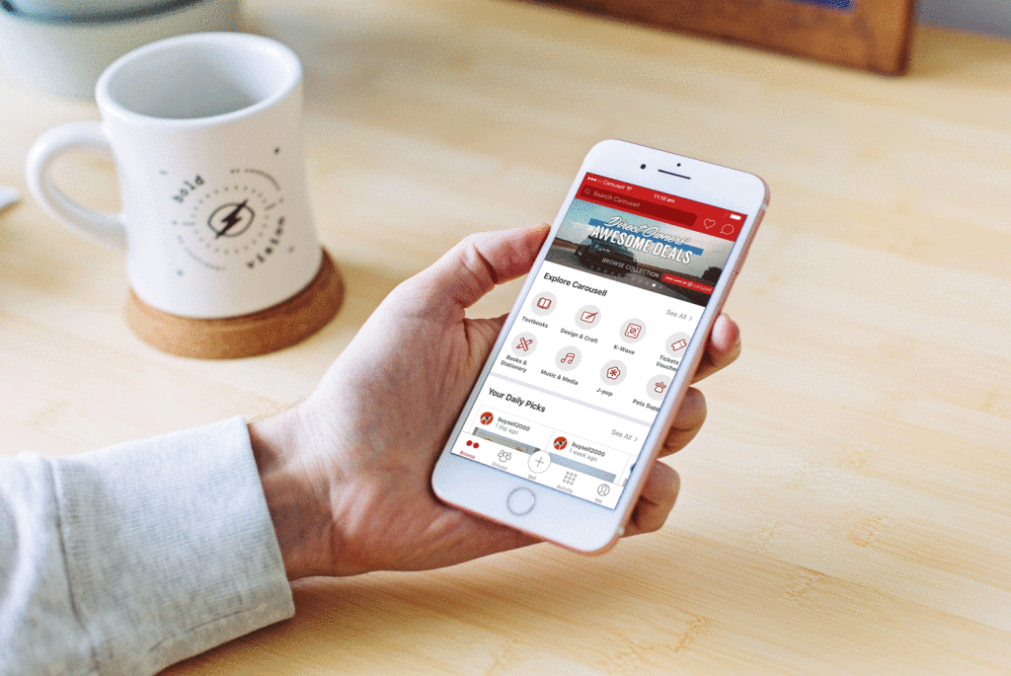

Carousell is launching its own digital wallet, CarouPay, to enable instant checkout, its co-founding CEO Siu Rui Quek revealed. This followed the news that the company had received US$85m from its Series C funding.

"Carousell’s foray marks the latest attempt to tap the potential of digital payments in a market of over 600 million consumers with a significant proportion of internet savvy, mobile phone enthusiasts.

In a bid to expand its presence in the payments space, gamer gear company Razer had earlier announced the acquisition of Malaysia-based MOL Global. The Malaysian firm claims to be one of the largest e-payment networks in Southeast Asia, having handled over US$1.1 billion of total payment value last year."

Read more here.

From Bloomberg Finance:

Singapore-based gaming and e-commerce firm Sea continued its struggle after its IPO as it said its losses more than doubled due to rising costs at mobile-shopping unit Shopee.

"The Singapore-based gaming and e-commerce company said its net loss during the three months ended in March was US$215.6m, compared with US$73.1m a year earlier. Total revenue rose 65 percent to US$155m.

Sea, which initially modeled itself on China internet giant Tencent Holdings Ltd., has struggled since its initial public offering in October. It has invested heavily to expand beyond games into payments and e-commerce. Growing losses have weighed on its shares, which were sold in the IPO at US$15 and closed at US$10.64 in New York."

Read more here.

Advertise

Advertise