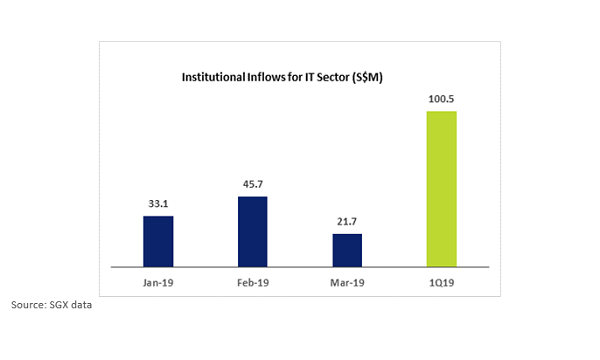

Chart of the Day: Institutional inflows to IT sector hits $100.5m in Q1

Its institutional inflow is the second-highest after REITs at $242.6m.

This chart from SGX shows the $100.5m institutional inflow of the IT sector in Q1, representing a total return of 28.6% following a 16.3% decline in 2018.

IT is said to be the best-performing sector in the quarter and amongst the top net buy sectors. Its institutional inflow is the second-highest after REITs at $242.6m.

The 20 largest IT stocks on SGX have a combined market cap of nearly $16b and averaged a total return of 21.7% in the 2019 YTD. They also averaged a PE ratio of 13.6x, ROE of 13.8% and dividend indicated yield of 3.5%.

The five best performers in the YTD were: Hi-P (+65.0%), TPV Tech (+46.2%), Innotek (+41.0%), Venture (+37.9%), and CSE Global (+36.8%). The five have averaged a YTD total return of +45.4%, bringing their 1Y and 3Y total returns to +11.9% and +194.3% respectively.

Advertise

Advertise