61% of Singaporean SMEs held low credit standings pre-COVID-19

The hospitality, retail and construction sectors were in bad positions before the circuit breaker.

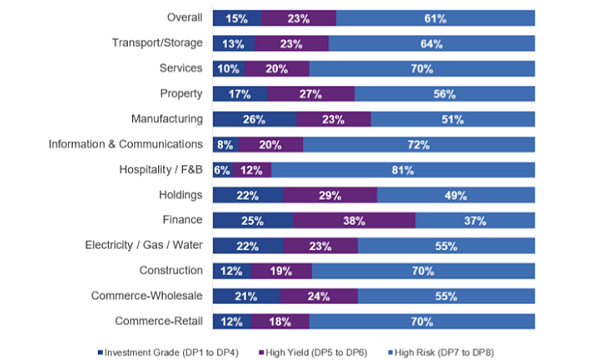

Sixty-one percent of small and medium-sized enterprises (SMEs) have demonstrated lower credit ratings by end-2019, which made them more exposed to short-term vulnerabilities in adverse economic conditions amidst the COVID-19 pandemic, according to a survey by Experian.

The figure also meant that SMEs were vulnerable in the areas of credit standing, cash flow, liquidity, and liabilities. Such ‘high risk’ SMEs would have had existing access to capital challenges with lenders, given lacklustre trading conditions in 2019 and the companies’ weaker credit profiles.

The report revealed that business challenges in 2019 were exacerbated by the US-China trade war, a weakening manufacturing output and weak discretionary consumer spending. As a result, sectors with weaker credit ratings are hospitality/F&B (81%), information & communications (72%), commerce-retail (70%), construction (70%) and services (70%).

In addition to credit ratings, Experian also analysed the SMEs’ near time financial strength, with short term cash flow and debt exposure a concern for most SMEs. Whilst overall working capital remained positive, organisations in commerce-retail, construction, hospitality/F&B, and property appear to be experiencing challenges related to cash flow.

Seven out of 12 sectors surveyed registered negative profit margins, which is a concern especially for sectors comprising younger SMEs where their ability to generate returns over time were comparatively weaker.

“Whilst micro SMEs (organisations with a turnover of less than $1m) usually hold weaker financial positions due to thinner profit margins, their larger counterparts (organisations with a turnover of $1m to $10m) were observed to also be struggling with negative margins,” Experian observed.

Furthermore, the study added that amongst these high-risk SMEs, 15.5% of such SMEs were deemed likely to delay payments. Most of these firms were found to be under the hospitality/F&B (36.7%), construction (35.1%) and manufacturing (27.5%), suggesting possible weakness within these sectors.

The average length of time on how quickly SMEs pay their debts fell by five days to 33 days in Q1 compared to Q4 2019. In addition, 13% of SMEs’ debts in Q1 were paid in more than 90 days beyond terms, a 19% crash over the same period. “This may reflect a tightening in supplier credit, especially in sectors such as construction (improvement by 14 days) and commerce-retail (improvement by 13 days), where sector confidence is weak, and creditors are following up on payments with greater urgency,” Experian added.

Advertise

Advertise