News

Ministry of Law rolls out temporary relief for contractual obligations

Ministry of Law rolls out temporary relief for contractual obligations

This applies to bank loans incurred by local SMEs.

Hotel S-REITs may opt to privatise: analyst

Their yields are largely supported by fixed rents for master leases.

ST Engineering bags contracts worth $1.6b in Q1

Over half or $838m were clinched by its aerospace sector.

MAS, SGX RegCo look into possible breach of rules in Eagle H-REIT

MAS directs the manager and trustee to safeguard interest of unitholders.

Daily Briefing: Temasek denies claim that CEO earns $100m a year; Pandemic heightens importance of food security, says experts

And remittance firm TranSwap in talks to close US$5-10m funding round.

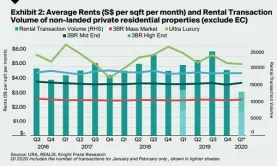

Chart of the Day: Condo rent volumes dipped 3.5% in Jan-Feb

Transaction volumes might further drop following social-distancing measures.

Daily Markets Briefing: STI down 0.64%

SGX saw the sharpest rise amongst top active stocks with a 1.12% climb.

Oil trader Hin Leong owes $5.47b to 23 banks

The pandemic has led to a slump in oil prices.

Singaporeans expect 3.1% inflation in the next twelve months

The survey showed a marginal easing of expectations on prices.

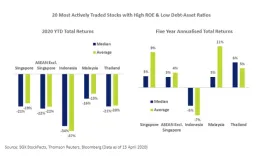

Stocks with high ROE and low debt post 19% average drop YTD

This mirrors the declines recorded in ASEAN stocks of the same criteria.

MAS signs MOU with EU regulator on financial benchmarks

It allows Singapore’s financial benchmarks to be used in the EU.

Keppel asset manager bags $598m for its infrastructure fund

The fund will have gathered total commitments of $811.73m.

SATS prices $100m notes due 2025 at 2.6%

Proceeds will be used partly for general corporate purposes.

MOF, IRAS, MAS launch relief measures for SGX-listed S-REITs

These include extending deadlines for distribution of income and raising the leverage limit.

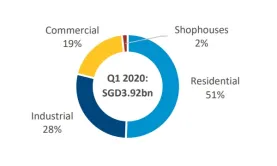

Chart of the Day: Residential sector led property deals in Q1

Residential investment was boosted by public land sales.

Daily Markets Briefing: STI up 0.09%

YZJ Shipbldg saw the sharpest decline amongst top active stocks with a 1.92% fall.

Hong Kong's co-working scene thrives as Singapore struggles

Co-working spaces provider TheDesk gained 25% more new members YoY in Q1.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform