News

Chart of the Day: Singaporeans take up four-fifths of home sales in 11M 2019

Chart of the Day: Singaporeans take up four-fifths of home sales in 11M 2019

About 6% of 18,400 units were bought by foreigners.

IMDA moves deadline of 5G licence bids to 17 February

Mobile network operators reportedly asked for more time to submit proposals.

Ascendas REIT's next big buy may be a business park property in Singapore

The Galaxis (One North), The Ascent and 5SPD all present near-term opportunities for A-REIT.

Singtel's Bharti Airtel launches $1.35b foreign currency convertible bonds

It was opened after the Indian Government charged $6.62b in unpaid dues.

SGX RegCo sets due diligence and independence standards for issue managers

It will refer to the ABS Listings Due Diligence Guidelines in evaluating IMs.

Hyflux creditors called to file a proof of claim

Parties who did not file by 5 February may not be able to receive payments.

Most fund managers to overweight China in 2020

Amongst regional responses, Europe was the most popular pick for overweight.

Daily Markets Briefing: STI up 0.05%

SGX led the gains amongst top active stocks with a 2.56% expansion.

Daily Briefing: SIA launches fifth weekly flight to India; Temasek's Pavilion Energy expands to Spain

And Vickers Venture Partners leads $14.9m round in UK-based Emergex Vaccines.

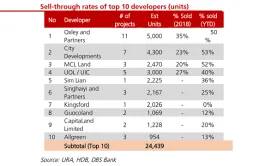

Chart of the Day: These developers had the highest sales in 2019

Oxley had a sell-through rate of 50% across 11 projects.

SGX scraps compulsory quarterly reporting based on market cap

Reporting will only be required for companies associated with higher risks.

Data to determine success of Singapore digital bank aspirants

Eight publicly known applicants want to focus on the country’s underbanked segment.

GrabFood opens first cloud kitchen in Singapore

A self-pick up option for customers would soon be introduced.

HDB resale prices dipped 0.3% in December 2019

The 3-room flats recorded the sharpest decline in prices at 0.8%.

GIC raises stake in Australian logistics trust to 49% for $339.49m

Proceeds will be initially used to reduce debt.

Construction demand expanded 9.5% to $33.4b in 2019

Demand for petrochemical facilities spurred growth.

GIC consortium wins Brazilian road auction for $366b

They are expected to invest $4.65b over 30 years.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform