News

Private residential property prices up 2.2% in 2020

Private residential property prices up 2.2% in 2020

Prices are expected to pick up in 2021 amidst booming buyer sentiment.

The Place Holdings to participate in mixed development project in Tanah Merah

The project will yield up to 265 condo units and 2,000 square metres of commercial space.

Singapore strengthens maritime sector COVID-19 regulations

Two new cases were recorded on 30 and 31 December 2020.

Economy contracted 5.8% in 2020

The manufacturing sector improved, whilst the services sector continued to falter.

Digital COVID-19 health pass approved for entrance to Singapore

Changi Airport will have a dedicated lane to digitally verify health credentials.

Singapore-Malaysia high speed rail project terminated

Malaysia to compensate Singapore for costs already incurred.

Market Update: STI closes year down by less than 1 per cent

The local index ended the last day of 2020 trade in the red, but was still ahead for the month of December.

3.2% cut to power prices in Q1

Electricity prices are set to fall in Singapore over the first quarter of the New Year. Wholesale provider SP Group announced on December 31 that the electricity tariff would decrease by an average of 3.2% (or 6.7 cents per kWH) for the period of January 1 to March 31. This is due to lower energy costs compared with the previous quarter, the company said.

FCT Singapore to sell off Anchorpoint Shopping Centre for $110m

The mall is in a prime location in Singapore's inner west.

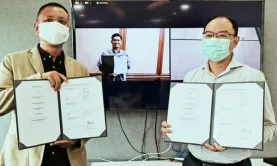

New option for mid-career HR training in Singapore

The public-private partnership aims to enhance the people management skills of Singapore's professional workforce.

Happy holidays: SBR on vacation until January 4

We're taking some time off!

MAS extends $80b swap agreement with US Fed

Its USD Facility will also be extended to end-September 2021.

Nine in 10 Singaporeans volunteer to cope with stress: study

Time spent with underprivileged groups alleviates COVID-19-related stress, research said.

Non-oil domestic exports dropped 4.9% YoY in November

Electronic NODX decreased by 3.8% YoY, whilst non-electronic NODX declined by 5.2% YoY.

Office rents to see positive growth in 2021: CBRE Research

The firm said office rents will pick up in H2 2021.

Razer Fintech, Rely launch 'buy now, pay later' service in SEA

The service will be made available to merchants under Razer Merchant Services.

SFF x SWITCH 2020 attracts 3.5 million views online

Over 60,000 participants from 160 countries participated in the five-day event.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform