News

Minimum stay for rental homes lowered to three months

In response to growing demand for shorter periods of stay.

Singapore equities outperform regional peers in 1H17

STI has climbed around 13%.

Keppel, PUB break ground for Singapore's fourth desalination plant

It is a dual-mode desalination plant.

What could Singtel get from the Netlink Trust listing?

There will be room for higher dividends.

OCBC sells stakes in Hong Kong Life Insurance

The divestment could yield $426m.

NODX to clock in 5% growth in 2017

After contracting for a second straight month in May.

Singapore IPO activity disappoints in 1H17

Eight IPOs launched in the said period raised only US$324m.

Daily Markets Briefing: STI up 1.34%

But the weakness on Wall Street could spark a similar correction.

Daily Briefing: Why it's not yet time to ease property measures; Are 1MDB penalties heavy enough?

And Singapore condo prices recover in May.

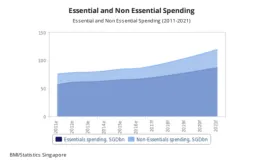

Chart of the Day: Essential goods to comprise 43.4% of household spending this year

Housing costs account for 20% of total expenditures.

SIA Engineering's line maintenance service to grow 8%

It will be the only segment to register a steady growth.

CDL Hospitality Trusts acquires German hotel for $153.8m

Germany will account for 6% of its NPI post-acquisition.

MAS inks fintech deal with Denmark

Fintech firms from Singapore will be able to expand in Denmark.

Keppel secures $85m vessel conversion and repair contracts

They are expected to be completed by 3Q18.

Del Monte Pacific partners with Fresh Del Monte Produce

They will develop a new retail F&B concept through a series of joint ventures.

Is Singapore beating Hong Kong as the best city for expats?

In terms of salaries, the rival city offers more.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform